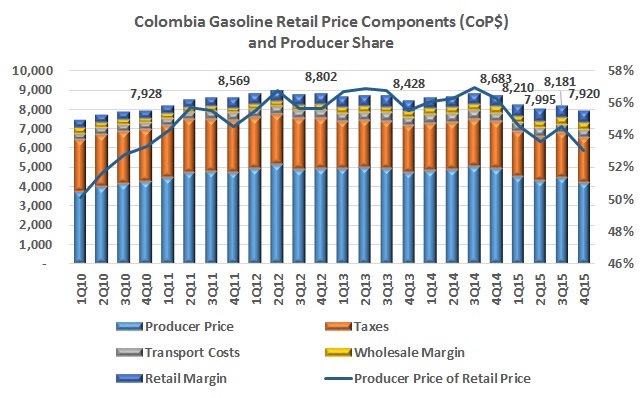

Senate President Luis Fernando Velasco has again called on the government to lower prices and accept a court ruling from December 2015 which deemed a fuel price stabilization tax from the last tax reform was not properly vetted. He says it would lower the fuel prices by CoP$1000 (US$0.30).

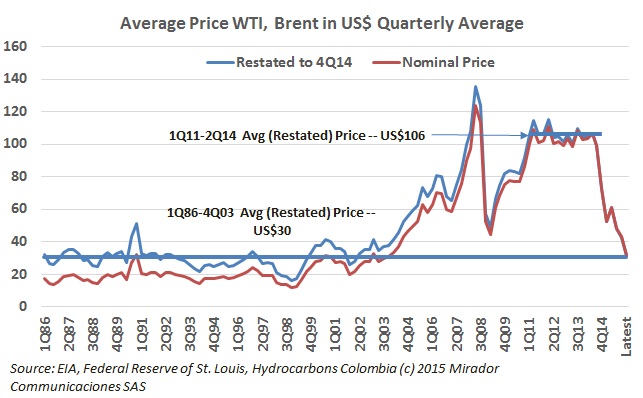

The headlines this week scream “Oil hits US$30!” noting that this was the first time this had happened in 12 years. There are lots of ‘oil prices’ but the benchmark most used by Colombian E&P producers, Brent, did indeed finish Tuesday at US$30.72 and closed today at US$30.26. The tendencies are worrying.

The government announced that fuel prices for January 2016 would increase slightly for gasoline and drop slightly for diesel. But five days later the Ministry of Mines and Energy (MinMinas) said that shortages of ethanol have forced it to adjust the mixture, and also the price. Fuel distributors allege that this has caused them losses.

Senate President Luis Fernando Velasco has called on the government to eliminate the fuel tax to benefit the average consumer, while an expert panel convened to study the matter has recommended doubling it.

Colombia has risen to the 10th spot in biofuel production according to the US Energy Information Administration (EIA), mostly based on sugar cane and palm oil. But an alternative source which could be applied is used vegetable oil, which authorities say is already being employed as contraband.

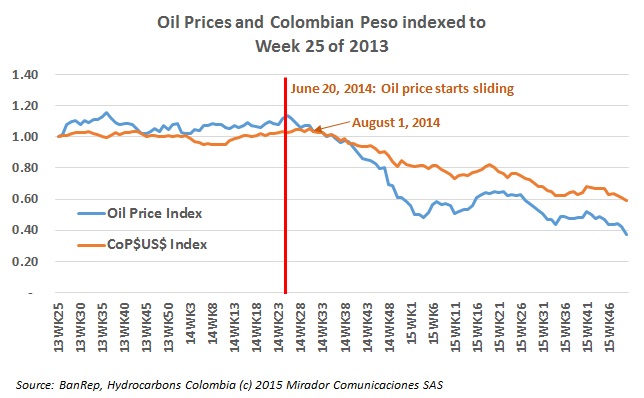

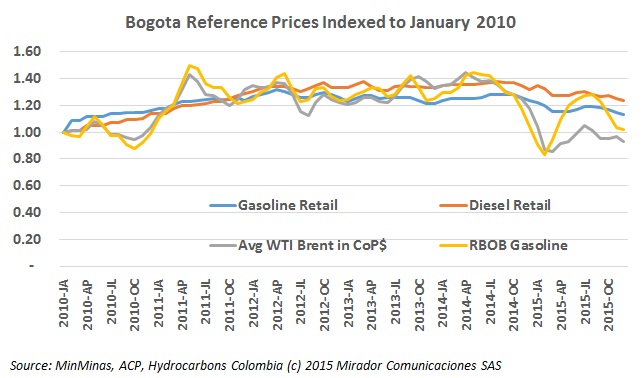

Government commentators and the local press blame the slide in oil prices for the significant devaluation of the Colombian peso seen in the past 18 months. The graph shows the kind of charts used to illustrate the point. We worked a little harder with some more rigorous statistical analysis and found that oil price movements are indeed important, explaining about 40% of exchange rate movements but this has only been the case since oil prices ‘fell off a cliff’ in the middle of last year.

Shortfalls in the supply of natural gas and drought due to El Niño weather could mean that thermal electrical generators will have to increase their use of diesel to generate energy, says a report.

A fund created in the tax reform last year which looks to guarantee stable fuel prices has been declared unconstitutional by Colombia’s Constitutional Court. The transportation industry says this will benefit consumers, while the government says it will study its options.

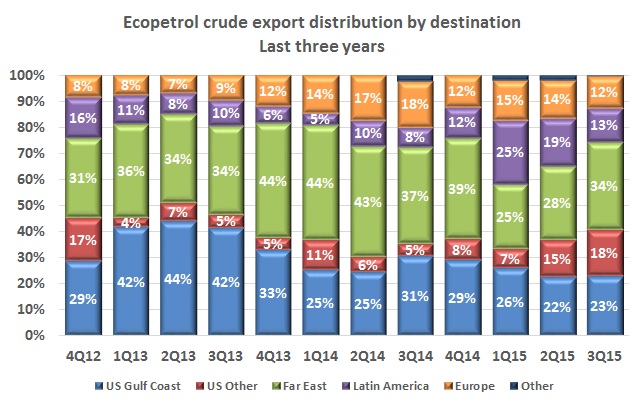

The battle over oil prices is a battle over production with Saudi Arabia saying it wants to regain US market share lost to higher-cost shale oil. But that is light oil and US refineries still need a significant supply of heavy crude due to the configuration of their plants. The graph shows that the US represents an increasing share of Ecopetrol (NYSE:EC) exports, at least over the last six quarters.

The Ministry of Mines and Energy (MinMinas) announced fuel prices for December, and diesel registered a bigger drop than gasoline, which the ministry says is at its lowest level in five years.