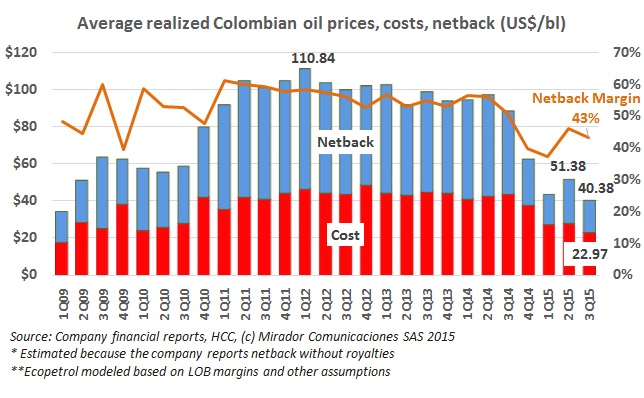

Colombia’s crude production is represented largely by Castilla and Vasconia crude, which have suffered even greater falls in value than the Brent or WTI benchmarks, meaning that with those latter prices hovering above US$30/barrel, production is barely profitable.

The high prices of sugar and the devaluation of the peso against the dollar have led ethanol producers to losses, said the biofuels industry association Fedebiocombustibles.

The El Niño weather phenomenon has meant the highest use of thermal energy generation in Colombia’s history, says the director of Jorge Valencia Marín of the Mining Energy Planning Unit (UPME). However he assures that the grid is working fine, and the historic use is still “normal”.

The Association of Large Energy Consumers (Asoenergia) says a planned regasification plant for Cartagena does little to address the energy issues, and called on the government to follow through with a reform of the distribution of the “reliability charge”.

The Bank of Bogotá produced a report in which it detailed the impact of four different oil price scenarios, and how these would affect the Colombian peso to US dollar exchange rate exchange rate, and as a result, government finances.

Former head of the National Hydrocarbons Agency (ANH) and now a university professor in Scotland, Armando Zamora says that communities, the government and the industry must be clear that the oil bonanza has ended, and that we are entering “the third age of oil”.

The Ministry of Mines and Energy has lowered fuel prices in February, and highlighted the falling fuel prices over the last year.

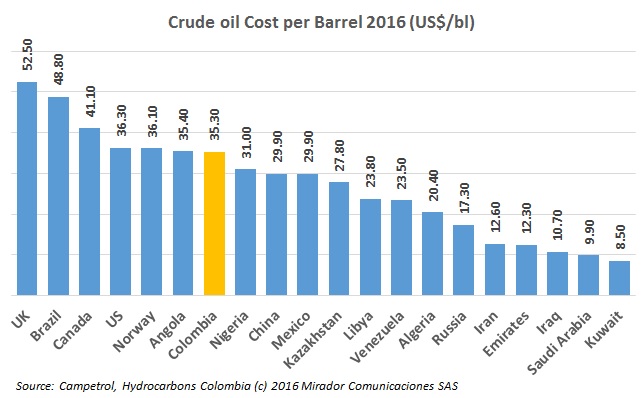

The Chamber of Oil Goods and Services (Campetrol) has published a graph which shows the average production cost per barrel of crude of the world’s largest 20 oil producers, Colombia’s average cost is US$35.30/barrel. This makes it the seventh most expensive producer.

Speculation has risen in the local press that the high proportion of heavy crude in Colombia and Venezuela means that already operators are selling oil below the cost of producing it.

The Finance Minister Mauricio Cárdenas gave an interview in the World Economic Forum’s annual Davos meeting and insisted that Colombia’s economy is successfully weathering the turbulence of the continued fall in oil prices. Meanwhile back in Colombia, doubts arise as to how to finance the government’s National Development Plan.