Accusations of unfair competition, of a monopoly and aggressive tactics against family-owned fuel stations have made press, with a particular emphasis on Terpel, which critics say has crossed a line as a wholesaler and retailer.

The Minister of Mines and Energy (MinMinas) Germán Arce confirmed that the ministry is open to studying a proposal from the truckers association to lower the price of diesel, as a trucker strike drags on since the beginning of the month.

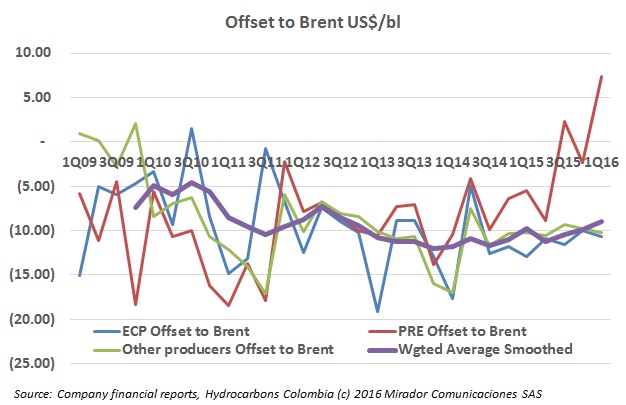

The fall in global crude benchmarks took Colombia’s realized sales price with it. According to figures from the Colombian Petroleum Association, Colombia’s price averaged US$26/barrel during the first quarter of the year.

Senate President Luis Fernando Velasco accused the government of charging illegal taxes in its fuel price formula even after they were struck down by a Constitutional Court ruling and alleged citizens are essentially subsidizing Ecopetrol (NYSE:EC).

A question from a subscriber – what is Colombia’s internal demand for crude? – provoked a top-of-mind answer, which is often not the correct answer. We were close but the graph shows the big numbers and the trend.

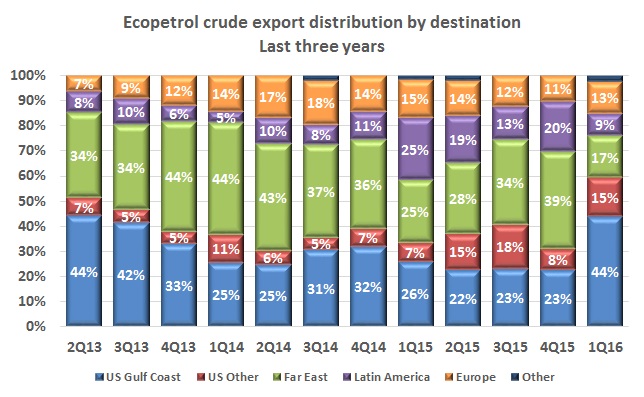

Ecopetrol’s (NYSE:EC) export distribution in 1Q16 showed a big shift to the US, the Gulf Coast in particular, and away from the Far East, which had been a strategic market for the NOC.

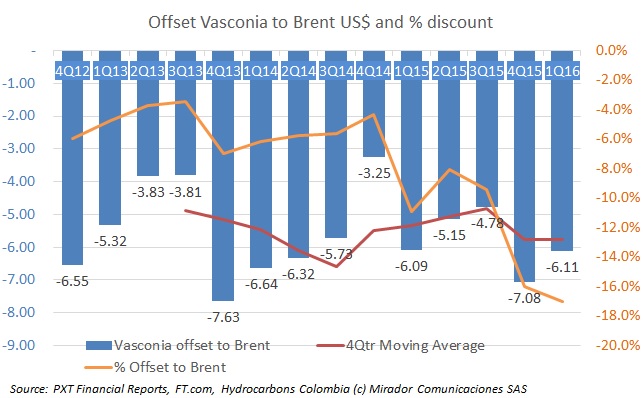

As oil prices have slid, we have been asked about trends in offsets to various oil price benchmarks. We found quarterly Vasconia figures (thanks to Parex) and so were able to check the offset between Colombia’s most important benchmark and what is today the most important global benchmark, Brent. The gap or offset between WTI and Brent has shrunk as prices decreased, what happened to Vasconia and Brent?

In a dramatic shift over just a few weeks, the rain brought back Colombia’s hydro resources, the halted Guatapé plant started working again and thermal generators slashed their natural gas purchases. Now paired with a global surplus of gas, low prices make some of Colombia’s strategic projects, especially offshore, look uncertain.

A decree that would lift restrictions to import ethanol has been criticized by Senators and the biofuels industry association, as were the delays and overruns at Ecopetrol’s (NYSE:EC) biofuel refinery, which is still under construction.

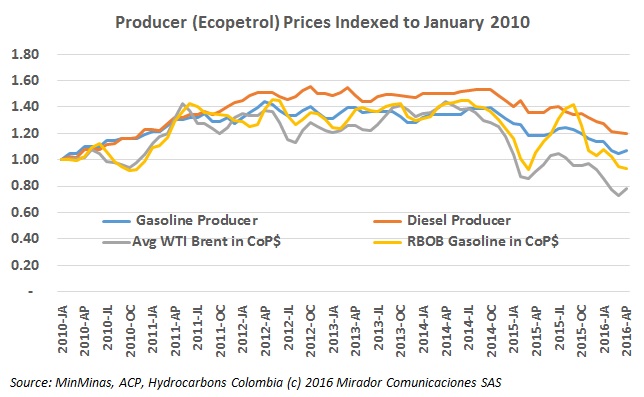

The Ministry of Mines and Energy (MinMinas) reported that once gain fuel prices will start to increase after successive drops in recent periods. The international price of fuel and increased biofuel costs were cited as the reason.