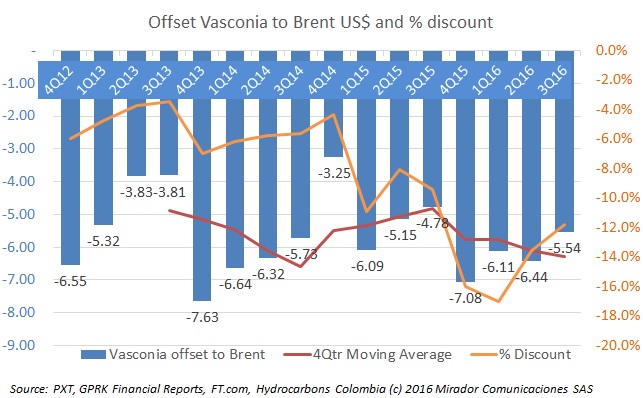

Mexico has its own benchmark price that policy-makers and the public look at to see if they are depressed or elated. Colombia does not have that habit – the newspapers and TV still mostly talk about WTI – but if it did, Vasconia would be the prime candidate.

Colombian brand Terpel will benefit from an agreement between Chile’s Copec and ExxonMobil. Terpel’s revenues are 66% of Copec’s total production.

The palm growing sector which sources most of the raw material to refine biodiesel is close to “receiving its death certificate”, according to the Jens Mesa, the president of the association which represents the sector, Fedepalma,

The Colombian Petroleum Association (ACP) said that authorities should allow greater fuel imports to serve national supply during production and distribution problems from infrastructure issues and strikes.

The Gazprom Group arrived last year in Colombia and by 2017 hopes to increase its presence in the country, expanding to eight cities.

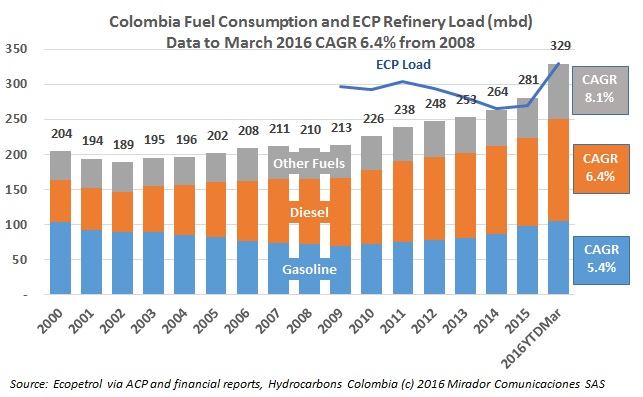

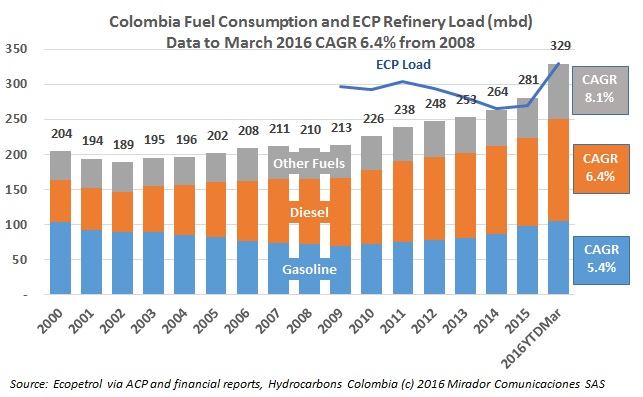

The office of the VP of economic affairs of the Colombia Petroleum Association (ACP) published a report that followed the primary trends and found a slight price increase, growing demand due to a closed Venezuelan border, and declining imports from the first quarter 2015 to the same period this year.

The truckers will no doubt be ecstatic to learn that diesel prices are going up once again.

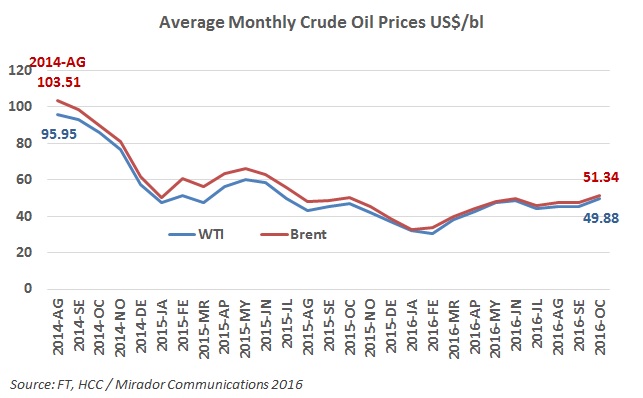

Oil prices for the critical fourth quarter started on the right foot in October with Brent at its highest average since August of 2015. But sentiment turned last week and the indicators are not good for November.

The Senate’s Fifth Commission held a debate to discuss “the war between foreign companies and retailers of the fuel market”, which touched upon issues like market consolidation and how fuel prices are determined.

In August 2015 Colombia imported US$479.2M in fuels and other products for extractive industries, and in the same month of this year that number grew 6.3% to US$509.6M, led by purchases of kerosene and light oils, even while the Cartagena Refinery (Reficar) grew its output.