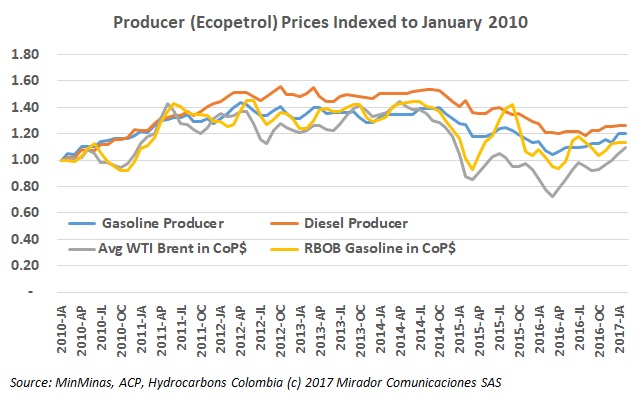

The graph shows fuel producer prices – what Ecopetrol (NYSE:EC) receives – which are unaffected by the so-called “Green Tax”. We think the graph shows Colombians are still paying too much although the gap has reduced somewhat.

Germán Castro, Executive Director of the Energy and Gas Regulatory Commission (CREG) spoke about regasification plants in Colombia, the government’s priorities and the sector’s perspectives on this.

Alejandro Martínez Villegas, President of the propane distribution association (Gasnova), is optimistic about the future of propane in the country. He mentioned that the construction of the new plant in Cartagena is vital to guarantee supply.

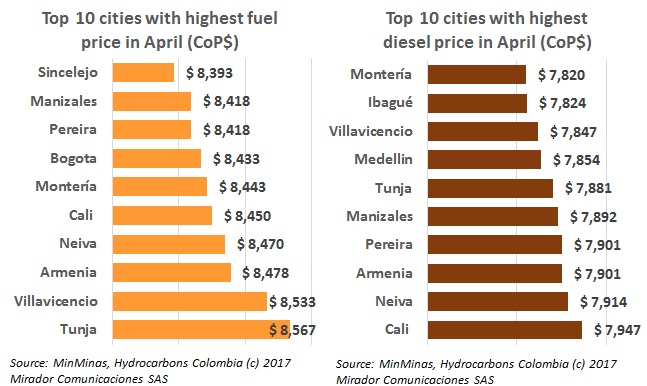

The Ministry of Mines and Energy (MinMinas) published the table of fuels prices for main cities of the country. There are many complaints about this decision.

MinMinas has ordered an increase in the bioethanol blend in fuel, from 6% to 8%, as a measure to mitigate Medellin’s pollution crisis.

Canacol’s CEO asked the Colombian government for more tax incentives for those exploring for gas and producing the fuel needed to supply the country’s domestic demand.

Barrancabermeja’s City Hall and economic associations will lead an indefinite strike to demand the refinery’s modernization, stopped back in 2010 as a result of the fall in international oil prices.

The Controller General called 47 Reficar officials and members of Ecopetrol’s (NYSE:EC) board of directors for an investigation into criminal responsibility, to discuss what happened with the technical analysis of the investments and cost that were incurred in the project.

At a time when low oil prices have forced Ecopetrol (NYSE:EC) to adjust its expenses and maintain a moderate exploration rate to ease its finances, the refining industry is emerging as the company’s hope for higher production margins and profits.

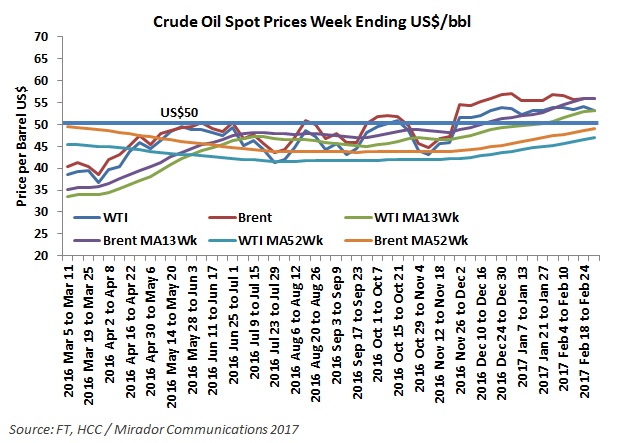

January, Brent averaged US$55.89 and in February US$56.24, a less than 1% change and identical in percentage terms to the change between January 2017 and December 2016. Yawn!