The project had an investment of CoP$43B and will guarantee natural gas supply for one million residential, commercial, vehicular and industrial users in Antioquia.

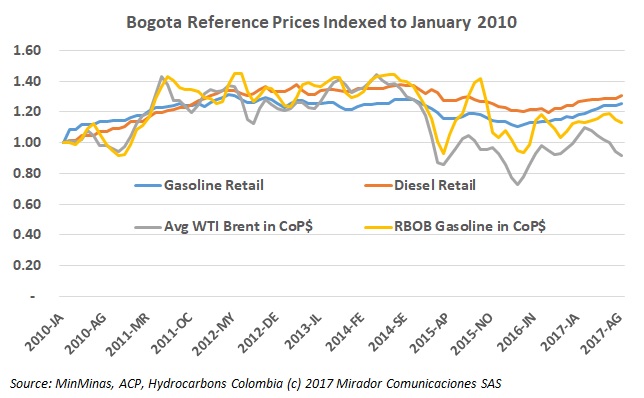

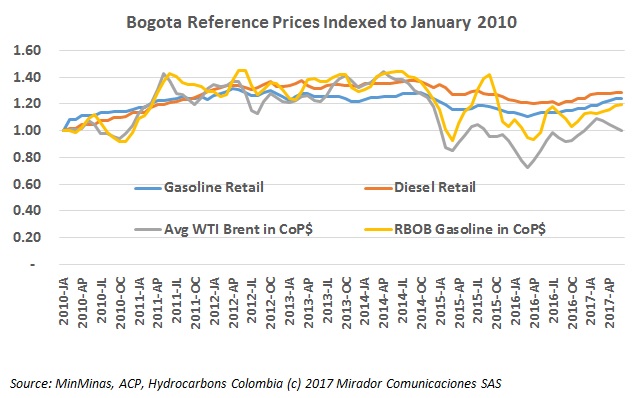

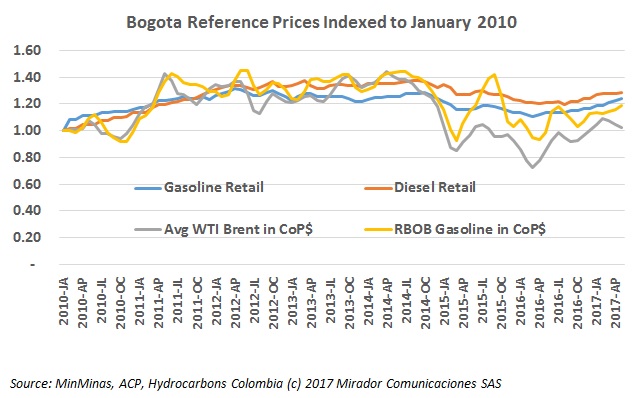

The Ministry of Mines and Energy (MinMinas) announced an increase in fuel prices. The Federation of Freight Transport Businessmen (Fedetranscarga) spoke about the high cost of fuels in Colombia.

The Ministry of Mines and Energy (MinMinas) announced the first decrease in the fuel prices since December last year.

Industry experts talked about how consumers would benefit from the liberalization of fuel prices in Colombia.

The Comptroller General proposed changing the gasoline price policy in the country. It generated an interesting discussion.

Despite assurances that Reficar is now “practically” online, refining volume dropped at the NOC’s flagship facility for the second straight quarter.

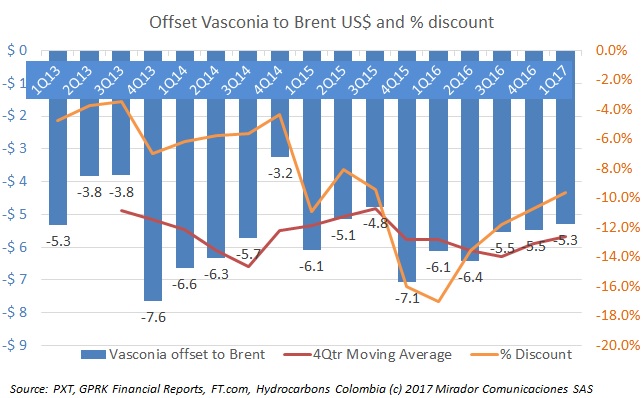

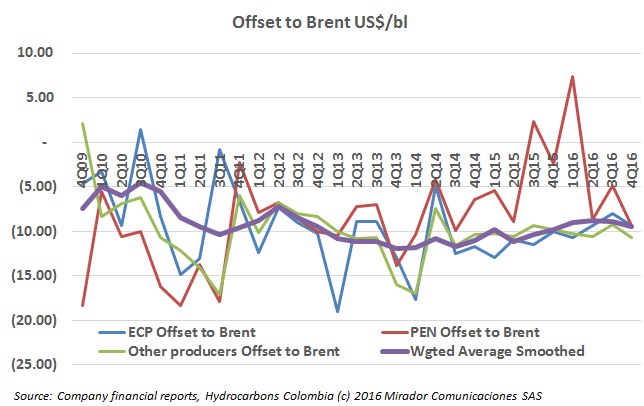

Vasconia is perhaps Colombia’s most ‘emblematic’ crude oil blend and last quarter the discount fell again, reducing the gap to Brent.

The Ministry of Mines and Energy announced a new rise in the fuel prices in the country. It has grown consistently since January this year.

Last year was difficult for the sector because of the continued oil price decline. The industry had to adapt to this environment and learn to operate with the lowest price in 12 years.

Valle del Cauca business associations defended the construction of the Pacific coast regasification plant because according to them, is an important competitiveness element for Colombia.