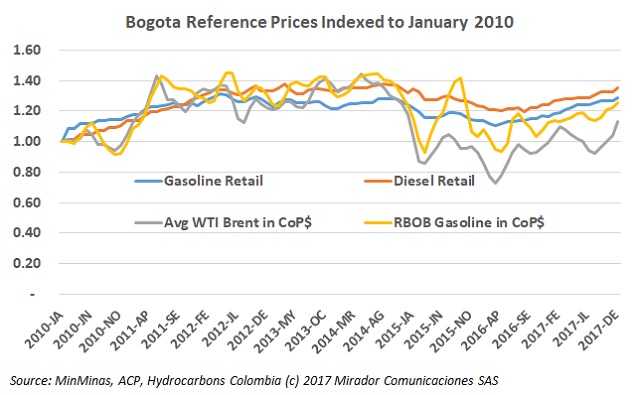

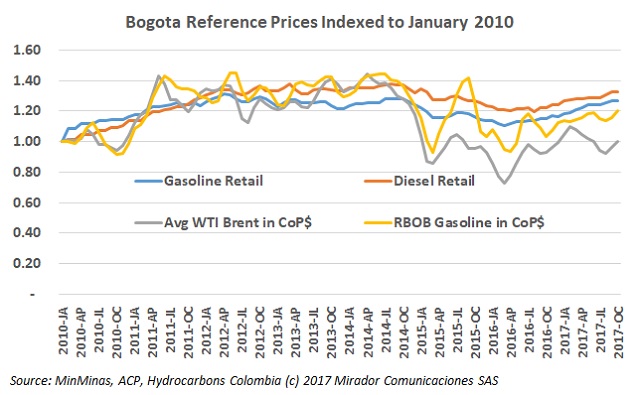

The Ministry of Mines and Energy (MinMinas) recently announced the new gasoline and diesel prices in the country, generating much discontent among consumers and business users. No one agrees with the management of fuel prices in Colombia.

The Ministry of Mines and Energy (MinMinas) announced fuel prices for December. Experts of the sector talked about the relation between inflation and fuel prices in the country.

The propane market is facing a situation of much uncertainty at present. Representatives of the sector have shown their concern about this. Authorities and companies in the sector must take measures to avoid major problems in the short and medium term.

The Ministry of Mines and Energy (MinMinas) announced fuel prices for November. A citizen filed a lawsuit against the ministry to change the definition of the fuel surcharge in Colombia.

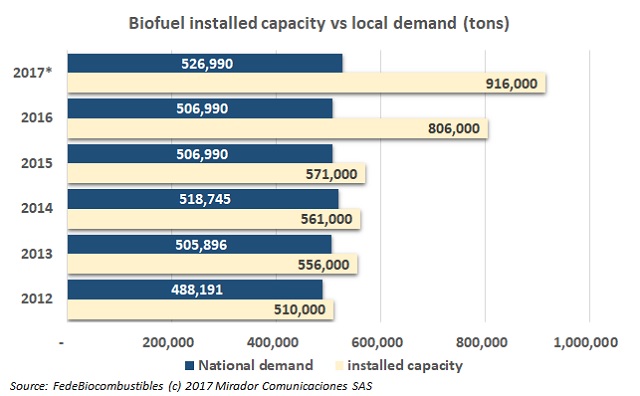

Valueskies announced its intention to build several bio-refineries in the country. Company representative Laura Ramírez spoke about the firm’s goals in Colombia.

Biodiesel producers and representatives of the sector have spoken about recent actions of the government, which would allow the free importation of this fuel, affecting the local industry.

The Ministry of Mines and Energy (MinMinas) announced fuel prices for October. Rutty Paola Ortiz, Vice Minister of Energy, spoke about prices prospects for this year.

The United States made a decision recently about the biodiesel market, which could generate changes in the international trade of this fuel, affecting Colombia’s interests in this issue.

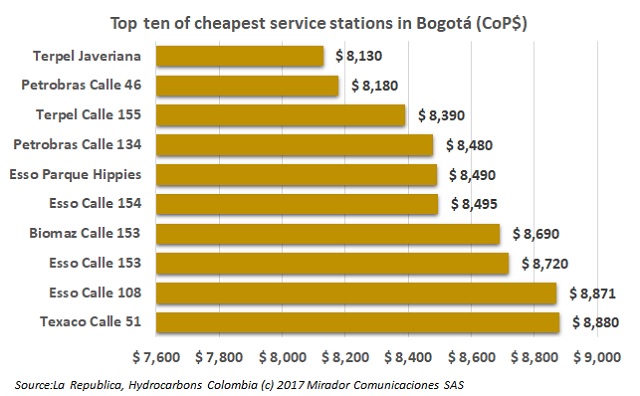

The continuous increase in fuels price generates discontent in the majority of the population in Colombia. The government gives no justification or few explanations for increased prices. National business newspaper La Republica conducted a survey of fuel prices in Bogotá service stations.

The Ministry of Mines and Energy (MinMinas) announced a new increase in fuel prices. The entity said that Hurricane Harvey affected prices in Colombia.