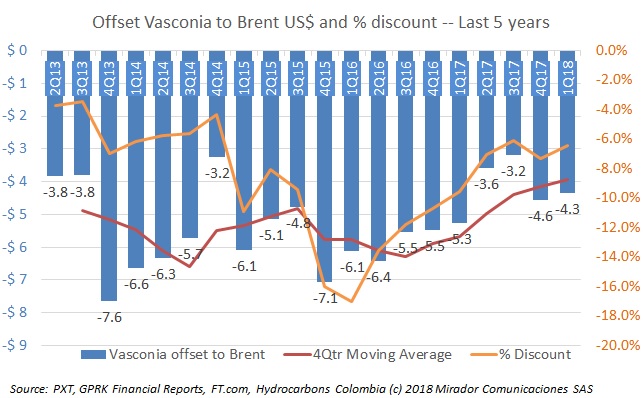

It has been many months since we updated our chart of showing the discount of Vasconia blend to Brent. Vasconia is the country’s most emblematic crude.

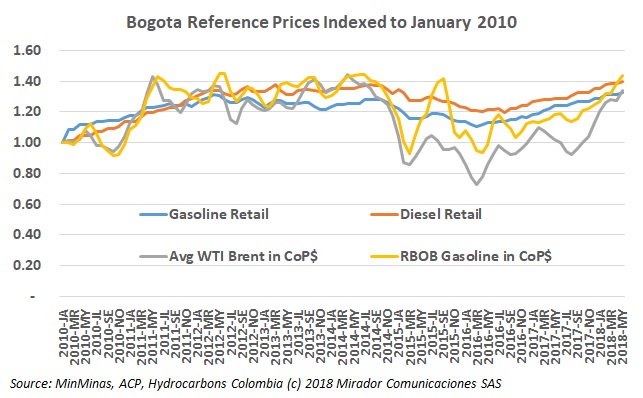

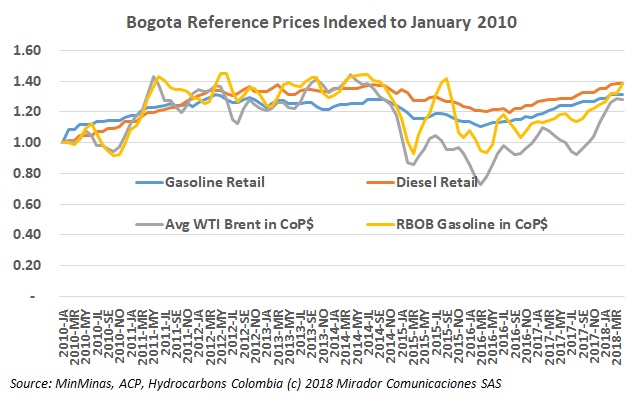

The Ministry of Mines and Energy (MinMinas) announced fuel prices for June this year. As expected, these increased and the entity explained the reasons for the new rise.

US ethanol imports totaled 27% of demand in February causing inventories by local producers to use almost all of their storage capacity. Industry association FedeBiocombustibles says American production has a 30% government subsidy and they cannot compete.

The Fuel Price Stabilization Fund (FEPC) was created to reduce the impact of the international prices volatility on the local market. However, the FEPC has reported a huge deficit and it continues to grow.

A few weeks ago, a long-simmering scandal resurfaced with news that the Attorney General’s office had ordered the retention of several ex-employees of the Meta Governor’s office involved with the Llanospetrol project. They had worked for former Governor Alan Jara. Now he has defended the project to the press.

The Ministry of Mines and Energy (MinMinas) announced fuel prices for May.; these increased and the entity explained the reasons for the new rise. Representatives of the sector also spoke about prices behavior.

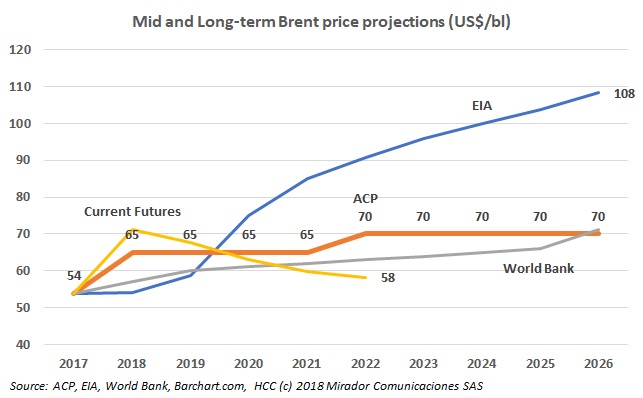

Recently the ACP announced its long-term price forecasts out to 2028. They also compared their numbers to other, publicly-available projections. We provide our own version of the comparison graph, translate some of the ACP’s commentary and give some of our own.

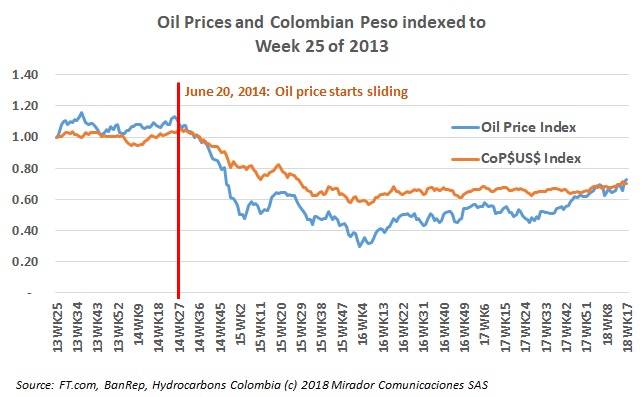

The HCC Analyst was concerned to see his graph of oil prices and the Colombian peso / USD exchange rate used in Friday’s newsletter without – in his opinion – the proper caveats. He demanded time to explain what was happening more carefully. (We think deep down he did not have anything else prepared, but we do agree that Friday’s article glossed over some important points.)

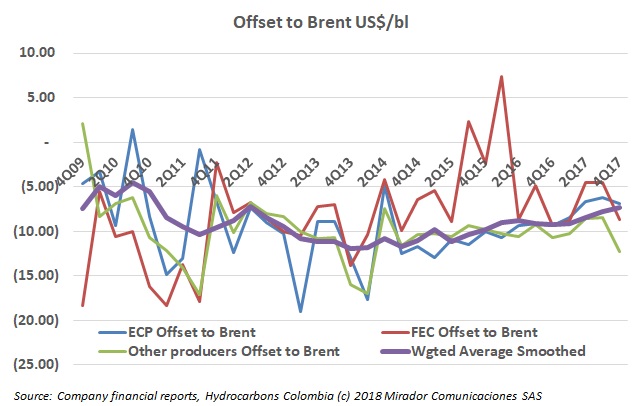

Ecopetrol (NYSE: ECP) reported good financial performance in 2017, and prospects for this year are positive as well. Oil prices and the discount to Brent played a key role in this issue, benefiting all Colombians.

The Ministry of Mines and Energy (MinMinas) announced fuel prices for April. The entity took measures to improve fuel quality and reduce pollution.