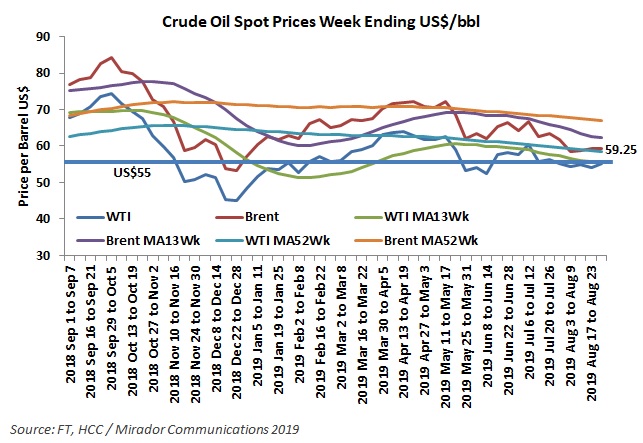

The conflict in the Middle East increased oil prices, creating high expectations about possible economic benefits for Colombia. This is why the country has not seen any benefits yet.

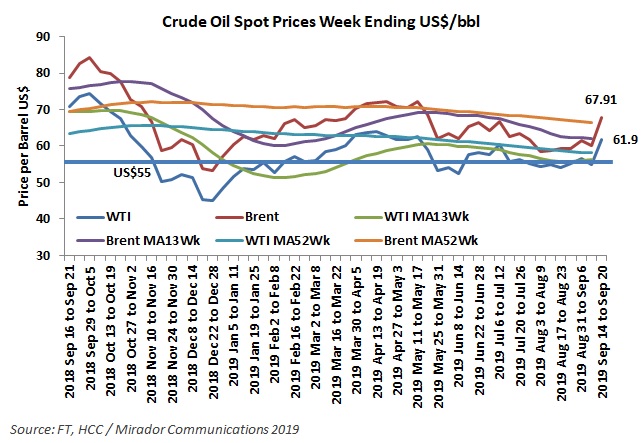

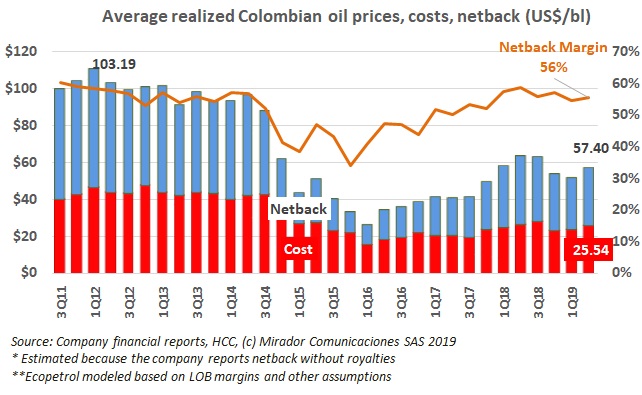

A couple of weeks ago we wrote about oil prices concluding that “Your CFO is unhappy because prices are low and appear to be falling.” CFOs were no doubt happy in 2Q19 because netbacks (on average) were up.

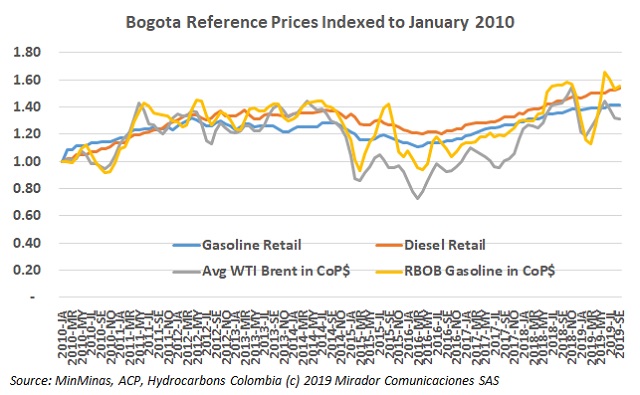

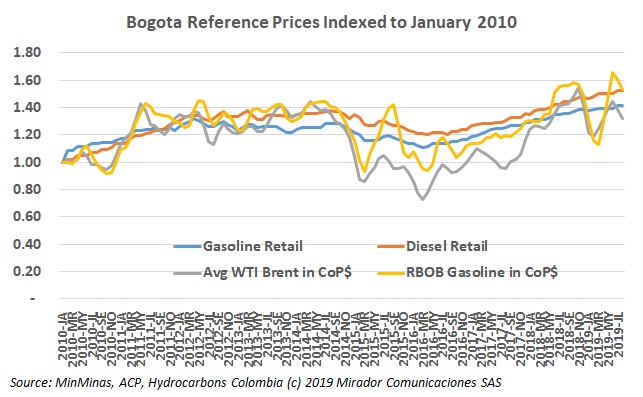

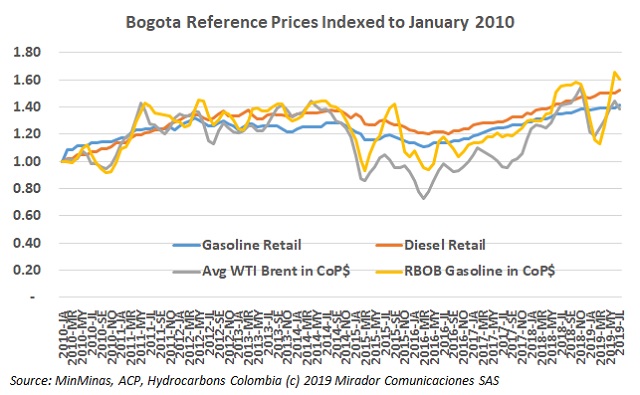

The Ministry of Mines and Energy (MinEnergia) announced fuel prices for August 2019, highlighting the performance of this metric during this year. However, these remain high compared to figures of last year.

A couple of years ago we wrote an article called Your CFO is smiling which talked about rising oil prices. Maybe it has been harder to find a smile lately and budgeting and planning season is coming up…

The Ministry of Mines and Energy (MinMinas) announced a slight decrease in fuel prices for August 2019. However, these remain high compared to figures of last year.

Authorities are investigating alleged irregularities at Ecopetrol’s (NYSE:EC) El Alcaraván ethanol plant in Puerto López (Meta).

The new president of the Colombian Cargo Transporters Federation (Colfecar), Juan Miguel Durán, spoke about his goals for the sector.

The Colombian government has not raised producer prices since March but a 1.5% increase in the pump price has some experts speculating about inflation.

The Ministry of Mines and Energy (MinMinas) announced a new increase in fuel prices for July 2019. The government had not changed the prices since March this year.

The president of Fedebiocombustibles, Jorge Bendeck, spoke about the impacts of tariffs in the biofuels sector.