The Ministry of Mines and Energy (MinEnergia) announced fuel prices for August 2023. Here are the details.

The new Minister of Mines and Energy (MinEnergia), Ómar Camacho, talked about the Fuel Price Stabilization Fund (FEPC), fuel prices and energy transition.

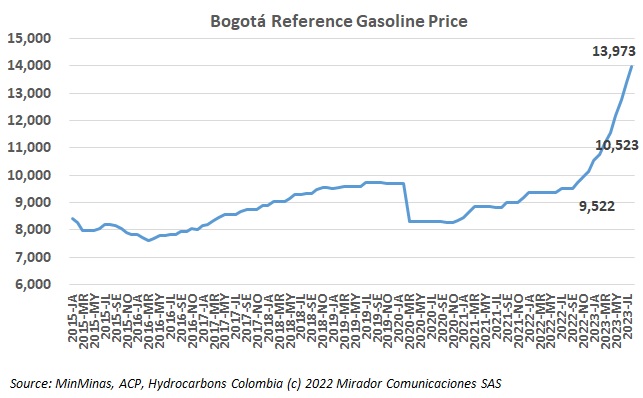

Gasoline prices in Colombia might not increase in August, and here is why.

The country eagerly awaits an official announcement on a potential new increase in gasoline prices in Colombia. While the government has yet to confirm a new hike, experts and analysts have been closely monitoring the situation and making projections.

The National Federation of Biofuels (FedeBiocombustibles) has taken a significant step towards promoting sustainable aviation by signing a memorandum of understanding with the International Civil Aviation Organization (ICAO).

Aurelio Ferreira, president of the Ibero-American Propane Association, spoke about the work being done on renewable propane.

Minister of Finance (MinHacienda) Ricardo Bonilla addressed the concerns of truckers regarding the anticipated increase in the price of diesel fuel.

The Colombian Ministries of Finance (MinHacienda) and Minas y Energía (MinEnergia) published a project decree aimed at eliminating stabilization subsidies for major fuel consumers covered by the Fund, including diesel and gasoline.

Fedetranscarga expressed concern and issued a call to the government regarding the potential implications of diesel price hikes.

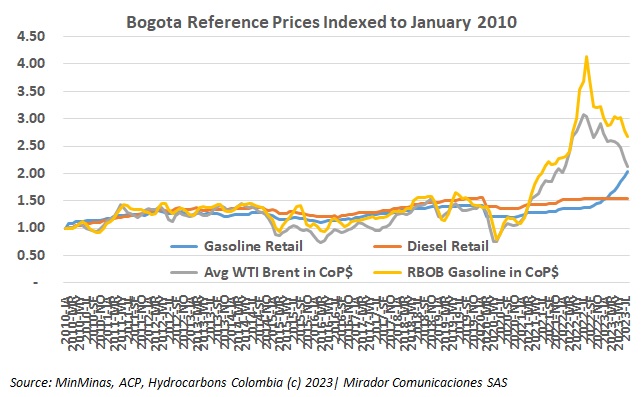

The Fuel Price Stabilization Fund (FEPC) accumulated a debt equivalent to 2.5% of the Gross Domestic Product (GDP) in 2022. As a result, the government has initiated adjustments to the gasoline price to reduce the size of the subsidy provided.