NG Energy International Corp. (TSXV: GASX) announced the results of its independent evaluation of natural gas and condensate reserves and resources in 2022.

Gases del Caribe announced the operations approved by the company’s administrators for 2023.

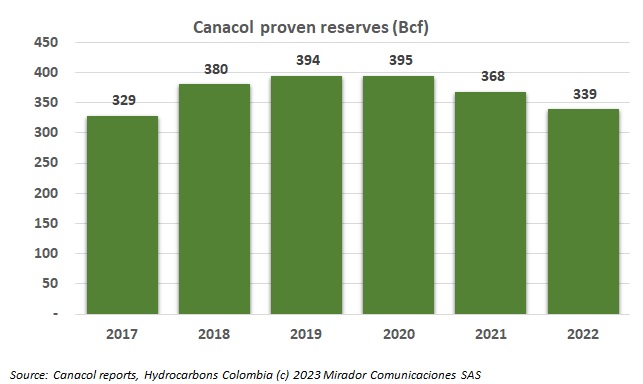

Canacol Energy (TSX: CNE) announced its financial and operational results for the three months ending December 31st, 2022.

Colombia’s ambassador to Venezuela, Armando Benedetti spoke about the possibility of acquiring Monómeros through Ecopetrol (NYSE: EC).

The current government planned to import natural gas from Venezuela, but the deal may be in jeopardy due to a recent PDVSA corruption scandal.

Gran Tierra Energy Inc. (TSX: GTE) announced its plans to boost oil production.

Canacol Energy Ltd. (TSX: CNE) announced its conventional natural gas and light/medium crude oil reserves for the fiscal year end December 31, 2022.

Hocol, a subsidiary of Ecopetrol (NYSE: EC), announced a natural gas discovery in the Department of Córdoba.

William Oviedo, Manager of natural gas distributor Alcanos, spoke about the contingency plans to avoid shortages in the department of Nariño.