Transportadora de Gas Internacional’s (TGI) regasification plant in La Guajira will be operational by early 2027.

Arrow Exploration announced successful completion of the Mateguafa 8 appraisal well at the Tapir Block in Colombia’s Llanos Basin, where the company holds a 50% beneficial interest.

GeoPark, led by President Felipe Bayón, renewed its crude oil purchase agreement with Vitol and extended the contract term covering production from Llanos basin blocks in Colombia. The new agreement stipulates that GeoPark will sell and deliver all crude production from Llanos 34, Llanos 123, and CPO-5 blocks to Vitol, with the expiration extended from June 2027 to December 2028.

French oil and gas company Maurel & Prom (M&P) announced plans to initiate a six-well exploration campaign at Colombia’s Sinú-9 gas field in February 2026 using a platform currently under assembly and mobilization.

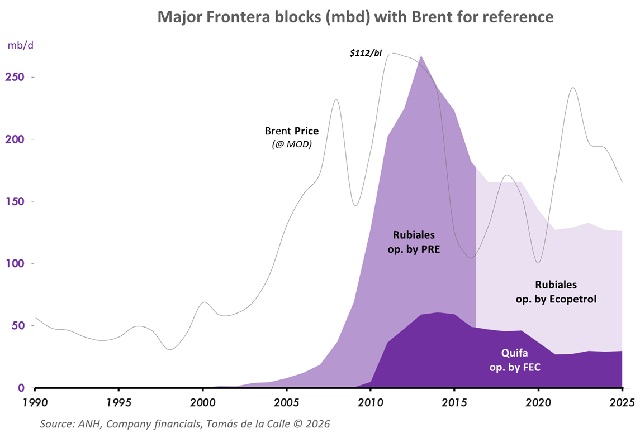

Colombian industry consultant and HCC contributor Tomás de la Calle was struck by the Geopark / Frontera transaction and inspired to write this historical reflection.

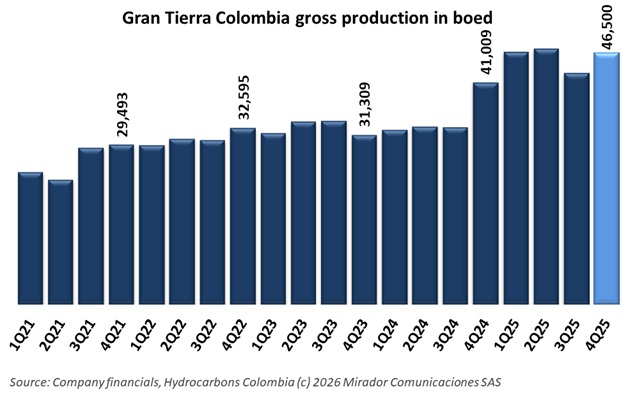

Gran Tierra (GTE) published a press release with a 4Q25 operations report and some unaudited 2025 numbers.

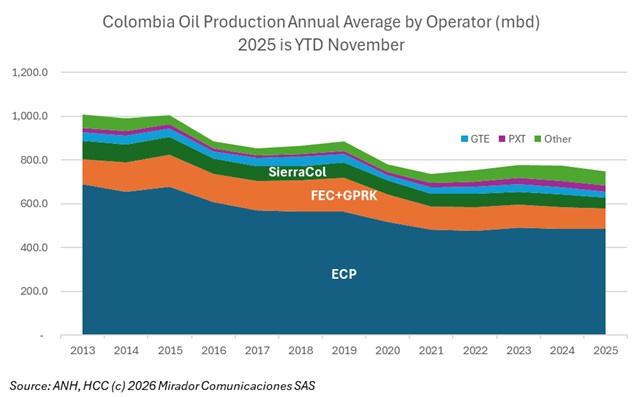

GeoPark CEO Felipe Bayón outlined an aggressive growth strategy following the company’s US$375 million acquisition of Frontera Energy’s Colombian assets, emphasizing the transaction represents long-term confidence in Colombia’s energy sector despite perceived risks.

Ecopetrol President Ricardo Roa confirmed the company’s Permian Basin field in Texas could be among assets under evaluation for divestment, responding to government opposition to fracking technology. The field, acquired under 2020 contracts, requires operational agreement updates and strategic decisions on future extraction.

Ecopetrol and Frontera Energy marked World Clean Energy Day with the inauguration of the new Quifa Solar Farm, incorporating 18MWp in the first quarter of 2026 and advancing Colombia’s energy transition.

Geopark announced a transformational acquisition of Frontera Energy’s entire Colombian exploration and production portfolio for US$375M cash at closing plus US$25M contingent upon achieving development milestones.