Ecopetrol’s (NYSE:EC) president Javier Gutiérrez said that the Asian market is emerging as a key receiver of Colombian oil while the US increases its self sufficiency in energy matters, and says the country is competitive in the Orient.

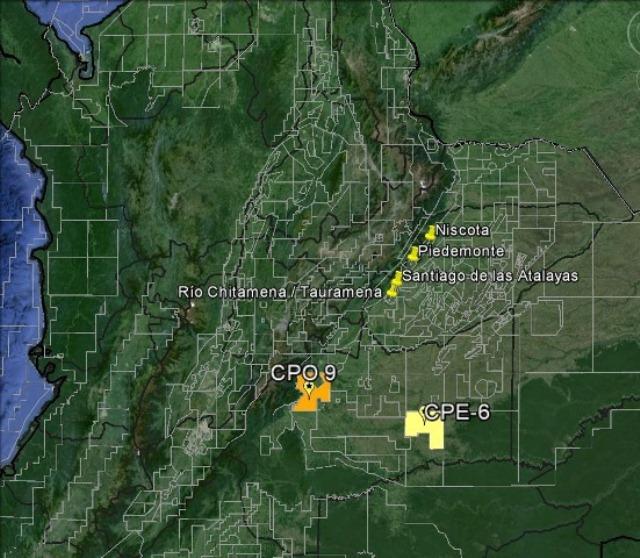

Talisman Energy (TSX:TLM) says that following advances in environmental licensing and exploration activity in the blocks CPE-6 and 9, the firm expects Colombia to form an important part of its operation looking forward.

Pacific Rubiales Energy (TSX:PRE) says that it has received the environmental license from the National Environmental Licensing Authority (ANLA) for exploration and production activities in the CPE-6 and Guama E&P blocks, following several extended delays.

Pacific Rubiales Energy (TSX:PRE) says it has reached a preliminary agreement to negotiate a five year sales and purchase agreement of 500,000 tons of liquefied natural gas (LNG) with Gazprom Marketing & Trading (GM&T).

Ecopetrol (NYSE:EC) topped the rankings of the most admired company by opinion leaders in an annual Opinion Panel survey. Meanwhile, a business publication speculates as to how much each share of the NOC will pay at the end of 2013.

Pacific Rubiales (TSX:PRE) is planning to invest US$2B in 2014 with 30-35% going towards exploration, but says it is not currently planning any acquisitions after its recent buy of Petrominerales (TSX:PMG).

Ecopetrol president Javier Gutiérrez says that higher hydrocarbons prices, a favorable exchange rate and historic production levels have contributed to positive results for the 3Q13, but that attacks on transport infrastructure and community blockades remain a worry for the NOC.

It has been revealed the Colombia’s largest private oil operator Pacific Rubiales (TSX:PRE) sent a letter to Ecopetrol (NYSE:EC) in March to formally ask the NOC to apply its STAR secondary recovery technology immediately and not wait until the 2016 contract ends.

Colombia’s Labor Ministry absolved Pacific Rubiales (NYSE:PRE) of any wrongdoing against claims from the Oil Workers Union (USO) that it had engaged in anti-union practices and fired employees for their union activity.

Ecopetrol (NYSE:EC) says that it signed CoP$14T (US$7.44B) worth of contracts with suppliers from January to September of this year, of which 92% went to Colombian companies.