Ecopetrol’s board recently approved the company’s CAPEX budget as we reported yesterday in an article that focused on the Refining and Petrochemical business. Today we step back to look at the panorama.

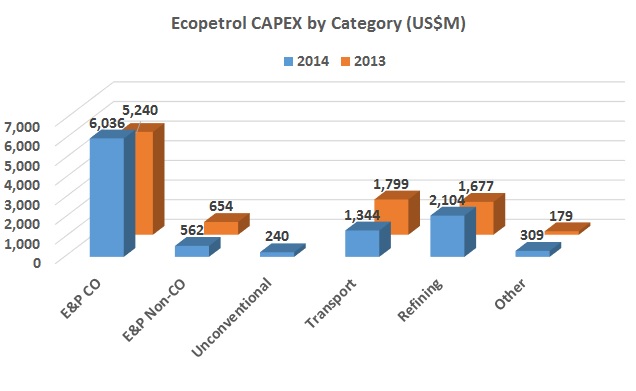

Ecopetrol (NYSE:EC) announced its Capex plan for 2014, with the NOC focusing nearly all of its US$10.6B within Colombia and its wholly owned projects as the firm looks to keep production levels in line with government goals in an election year.

Ecopetrol (NYSE:EC) and Talisman announce commercial viability in CPO-09 block, which will add 35 million barrels of reserves and marks the second addition by the NOC in as many weeks.

Pacific Rubiales Energy (TSX:PRE) says it has finished and launched an electrical transmission line that runs from the hydro-electrical center in Chivor, Boyacá to its flagship field Rubiales in Meta, which it says will save US$100M in operational costs annually.

Ecopetrol (NYSE:EC) has declared to Colombia’s National Hydrocarbons Agency the commercial viability of the Eastern Caño Sur block, adding 22.4 million barrels of 1P reserves.

Ecopetrol (NYSE:EC) awarded a group of 24 suppliers whose performance as contractors stood out as a model in 2013 in a ceremony held in Bogotá.

Estimates from Ecopetrol (NYSE:EC) are that upcoming phases of the current modernization work at the Barrancabermeja Refinery will employ up to 5000 people at its peak of activity in 2014.

Ecopetrol (NYSE:EC) is launching a pilot plant that will implement a chemical recovery technology in its 28-year-old San Francisco field as part of a larger strategy to increase production in mature fields.

This week the USO continued to call for the release of its Dario Cardenas Pachon, the VP of the Meta chapter, calling his arrest part of an orchestrated attempted by the government and oil companies to attack the organization.

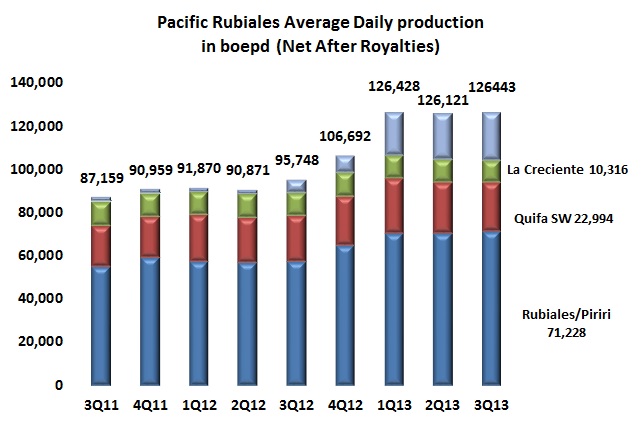

During Pacific Rubiales Energy (TSX:PRE) call to discuss its third quarter 2013 results the company’s CEO Ronald Pantin sought to convince analysts that its production portfolio will be sufficiently diverse by the time its flagship field, Rubiales, starts to decline.