Perenco said last week that it would shut down its operations in Aguazul after three months of blockades from the Tesoro Bubuy village. The action apparently was enough to bring the community to the table and lift the blockades, although talks still remain.

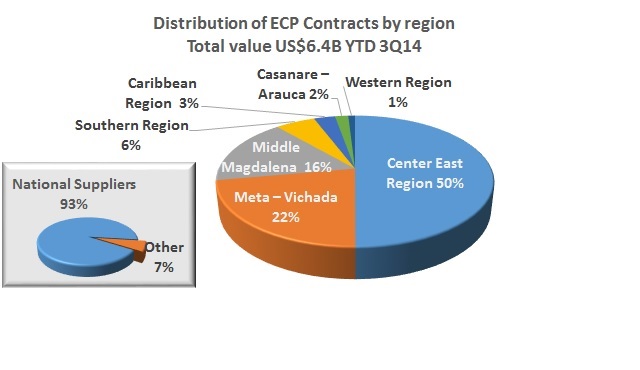

Ecopetrol (NYSE:EC) says that it has spent CoP$13.27T (US$6.27B) on goods and services during the first nine months of 2014, with 93% of that total going to suppliers based in Colombia.

Ecopetrol (NYSE:EC) had set a production target of 819,000boed for 2014, but with its average after three quarters sitting at 754,800boed, the NOC will almost certainly fall short of its goal.

Parex Resources (TSX:PXT) posted production and financial gains, growing production 27% sequentially, while revenues increased 24.9%.

Gran Tierra Energy (TSX:GTE) reported its third quarter earnings for 2014, and said that production and revenues had increased back above a dip experienced in the previous quarter. But considering its trend line over the last 7 quarters, its performance remains relatively flat, with oil prices and logistical issues on the OTA pipeline a recurring problem.

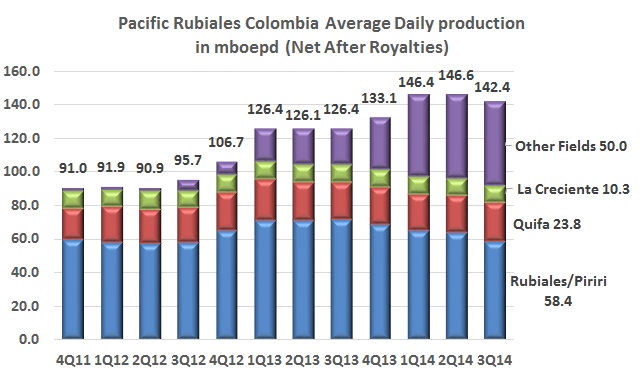

Production for Colombia’s largest private oil operator Pacific Rubiales (TSX:PRE) dropped in the third quarter of 2014 compared to the previous quarter, as water disposal issues continue to affect its flagship Rubiales field. Management looked to focus on the opportunities for other fields and expectations for Mexico, while ensuring that it would stay in Rubiales and that production would grow.

The oil workers union USO has been banging their drums about an Ecopetrol seismic contractor Sismopetrol, who had closed operations and left workers unpaid. Now Ecopetrol (NYSE:EC) has clarified why the work had stopped, and said it will compensate the affected workers.

David Riaño assumed the role of president of Colombia’s main gas transporter TGI around a week ago, and has now announced an investment plan of US$200M to invest in three strategic projects that will expand the company’s capacity.

Ecopetrol (NYSE:EC) management looked to highlight the positive aspects of the third quarter 2014 on its earnings conference call, pointing out that although profits dropped, production increased and attacks on infrastructure has dropped. While the firm will keep its projections for 2014 and 2015 for now, company president Javier Gutiérrez said a review of its strategy will be made towards the end of the year.

Ecopetrol has released its earnings report for the third quarter 2014, which showed a drop in profits for the quarter both sequentially (17.3%) and year-over-year (40.3%). The drop comes due mainly due to the drop in oil prices. The news left the Finance Minister (MinHacienda) Mauricio Cárdenas calling for the NOC to ramp up its production.