A survey of experts and managers involved in Corporate Social Responsibility (CSR) programs said that Ecopetrol (NYSE:EC) is both the most visible proponent of CSR, and also the most respected.

The pending decision on the future of the Rubiales Field, still Colombia’s largest producer, is running out of time. But while the political decision and momentum to return the field to full Ecopetrol (NYSE:EC) control looks clear, the technical requirements of the aging field are not so cut and dry.

Ecopetrol’s (NYSE:EC) board of directors met last Friday (December 12) and confirmed the rumors: Javier Gutiérrez will step down as president of the NOC.

Ecopetrol detailed figures that illustrate the impact that the Barrancabermeja Refinery maintenance work has made on local hiring positions, while Equion says it is the first hydrocarbons company to receive certification for its labor practices. These and other stories in our periodic round up of Company Social Responsibility (CSR) reports.

Ecopetrol (NYSE:EC) president Javier Gutiérrez made a visit to the Meta Department and discussed the NOC’s presence in the region, touching on local hiring, fracking use and production.

With only days before the next meeting of Ecopetrol’s (NYSE:EC) board of directors, rumors abound that current president Javier Gutiérrez is on his way out, but who would replace him?

Ecopetrol (NYSE:EC) says that it has made a discovery of an accumulation of natural gas at its Orca-1 well in the offshore Tayrona block, the first discovery in the deep waters of the Colombian Caribbean.

Ecopetrol (NYSE:EC) announced hiring trends of its contractors over the last three months, and said that of the nearly 30,000 posts generated, 90% of them went to local labor.

Pacific Rubiales (TSX:PRE) announced their 2015 outlook, which looks to slash costs, facilitate cash flow and brace for a lower oil price. The main target is Mexico, where the company also announced a joint venture with Mexican investment group ALFA to develop projects in that market.

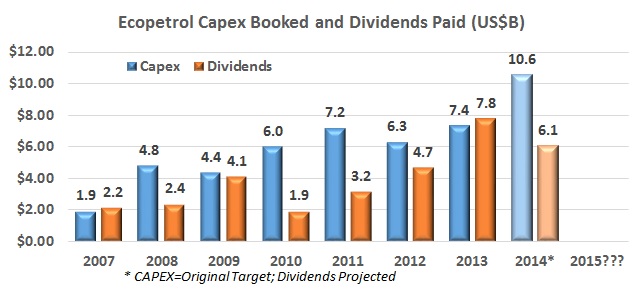

Ecopetrol (NYSE:EC) is planning to detail its investment plan for 2015, and, with a falling oil price, its Capex budget will have to drop, as speculation swirls around what other measures the NOC might have to take because of the new price scenario.