A study conducted by the Colombian Petroleum Association and Burson Marsteller with 37 oil companies in Colombia found that more than half of them want to move investment to countries with lower tax rates like the USA, Brazil, Peru or Mexico.

The Minister of Labor Luis (Lucho) Garzon led a meeting on Wednesday with workers, company representatives and government officials to address to potential impact that labor cuts could have on the oil regions. This is a follow-on to an article we published yesterday.

State owned Turkish firm Turkish Petroleum International Company has received its environmental license from the National Environmental Licensing Agency (ANLA) to proceed with a project in Norte de Santander.

It is safe to say that Ecopetrol (NYSE:EC) is confronting one of its toughest years in 2015, with a complex scenario both internally, as it searches for a new president, and externally, as the fall of oil prices cuts into its exploration budget and future revenues.

The Colombian Petroleum Association (ACP) says that the impact on E&P activities due to the fall of oil prices will start to make a strong impact on daily crude production, which will likely start to decline in 2016.

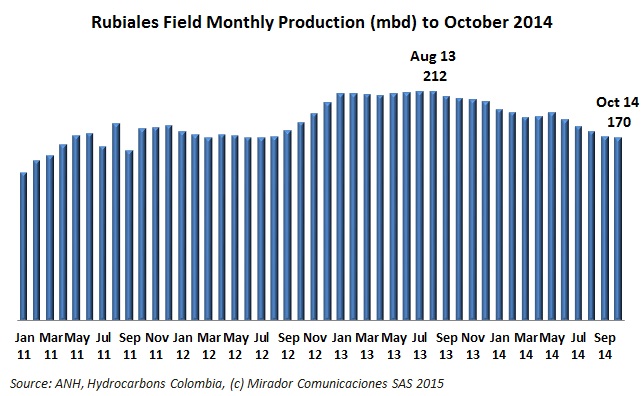

This article is not about Pacific Rubiales (TSX:PRE). It is about Colombia’s most productive field and the challenges of maintaining the 1mmbd goal.

The low price of oil could be an opportunity for Ecopetrol (NYSE:EC) to take advantage of smaller companies struggling with their cash flow and financial obligations and grow their proven reserves through acquisitions, argues a columnist.

Pacific Rubiales (TSX:PRE) continues to take a hit with investors, accumulating nearly a 50% drop on the TSX over the last month, with investors punishing the stock simultaneously with a company announcement last week that it would put exploration on hold to focus on production in 2015.

Ecopetrol (NYSE:EC) says that it has held workshops to train local leaders and residents in 332 municipalities on how to adequately react to an emergency, a program that is now in its third year.

The international oil price scenario might be grim, but Ecopetrol has some good news to celebrate as its Chichimene Field reached a new daily production record. But in the current price scenario, how important will this milestone be?