Ecopetrol (NYSE:EC) president Juan Carlos Echeverry gave another interview, emphasizing offshore and clarifing that in the Llanos development remains strong despite cuts in investment.

Colombia’s watchdog on corporate activity, Supersociedades, studied 53 companies from the oil and gas sector and concluded that 23 or about 40% were at a high risk of declaring bankruptcy.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry says that the NOC has more austerity measures coming, but that thus far there are no mass layoffs planned. He also said fracking must continue to be an option.

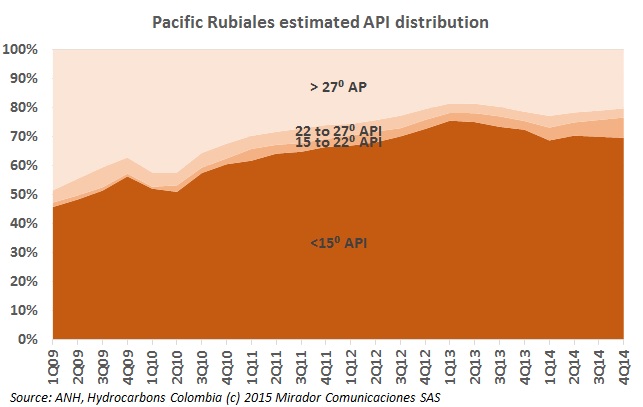

In order to lower its costs in the current oil price scenario, Pacific Rubiales Energy (TSX:PRE) is taking measures to get better value out of its light and medium crude and sell at a higher price.

The General Comptroller (CGR) says that Ecopetrol (NYSE:EC) has incurred a CoP$16.5B (US$6.5M) loss due to poor control and contract management when receiving fields being operated by other operators, amounting to a loss of state resources, a charge which the NOC denied.

Natural gas distribution and commercialization firm Gas Natural Fenosa says that growth in the number of natural gas vehicles conversions stood out in its 24% increase in its sales volume during 2014.

Maybe finding gas has been seen as only a long double base hit, great news, but short of the high hopes of a home run. But the market forces in Colombia offer some protection from the turbulence of the global crude oil industry.

The new president of Ecopetrol (NYSE:EC) Juan Carlos Echeverry has made his first statements to the press, saying the NOC will focus on its most valuable fields, the Cartagena Refinery and offshore exploration.

After three weeks of blockades and protests from the El Morro community, which has led the the halt of operations at Equion’s Floreña well and facilities, community leaders have sat down with the firm and submitted eight demands that they are looking to see fulfilled.

Juan Carlo Echeverry spent his first day as president of Ecopetrol (NYSE:EC) on Monday, April 6 speaking with the outgoing president Javier Gutiérrez, presiding over his first board of management meeting and touring the NOC’s headquarters in Bogotá.