Record production from nearby fields, along with optimized contracts, processes and operations have helped the Barrancabermeja Refinery report operational profits, despite facing a rocky labor scenario within.

Pacific Exploration & Production (TSX:PRE), formerly known as Pacific Rubiales, came out with the surprise announcement that its president and director, José Francisco Arata will retire from his position, effectively immediately.

If the most recent timeframe for the Cartagena Refinery (Reifcar) is correct, the facilities will be finished six years behind schedule, expected to begin operation end-2015 or the first quarter of 2016 and would be the most modern refinery in Latin America. If it is finished on time.

GeoPark has helped develop training programs on IFRS standards, meanwhile the firm also has assisted in the coordination of an educational seminar on free competition. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.

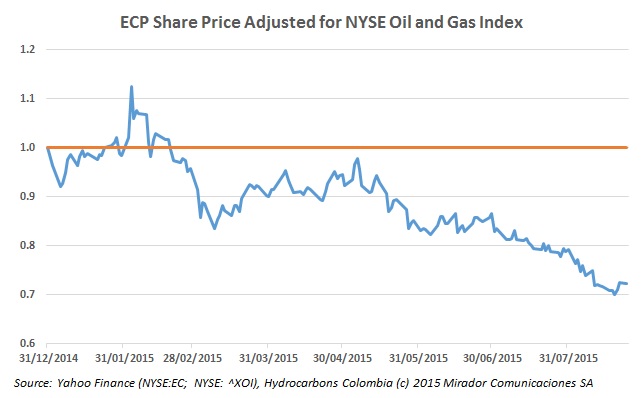

Ecopetrol’s (NYSE:EC) stock has fallen to historic lows on the Bogota exchange and has also suffered in New York, while the company’s president Juan Carlos Echeverry calls for calm.

The president of Ecopetrol (NYSE:EC) has been promoting cost cutting programs that will clip CoP$1.4T (US$465.7M) from the company’s operational costs and help it confront the price scenario profitably.

Pacific Rubiales (TSX:PRE) held its production in the second quarter of 2015, reduced its operating costs and grew its netback per barrel, but low oil prices and a decreased sales volume combined for a US$226.4M loss.

Ecopetrol (NYSE:EC) says that it has started testing the first units of the Cartegena Refinery (Reficar), and that full operations will start in March 2016.

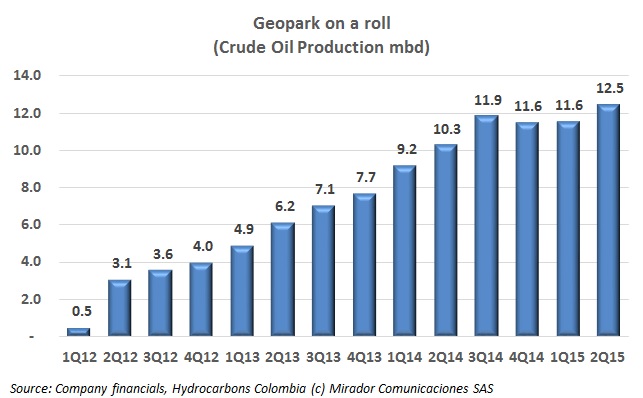

Geopark (NYSE:GPRK) saw a small drop in its consolidated production (including operations in Chile and Brazil) and financial results dragged down by the fall in oil prices, yielding a loss. But the firm has reopened suspended operations in Colombia after a cost restructuring, and added new production for a 22% increase.

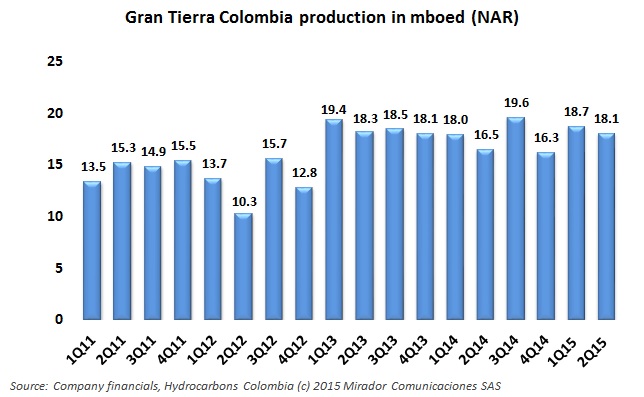

Gran Tierra Energy (TSX:GTE) issued its results for the second quarter, the first full earnings period since a new management team took the helm of the firm and redirected its strategic focus to Colombia, posting steady but flat production and a narrowed net loss.