Ecopetrol (NYSE:EC) has confirmed that it has fired up its industrial services units at the Cartagena Refinery (Reficar), another step towards a full operational launch of the long-delayed project.

A combination of low oil price and attacks on oil infrastructure around the Tibú Municipality in Norte de Santander has led to accusations of mass closures by Ecopetrol that have affected around 1000 workers.

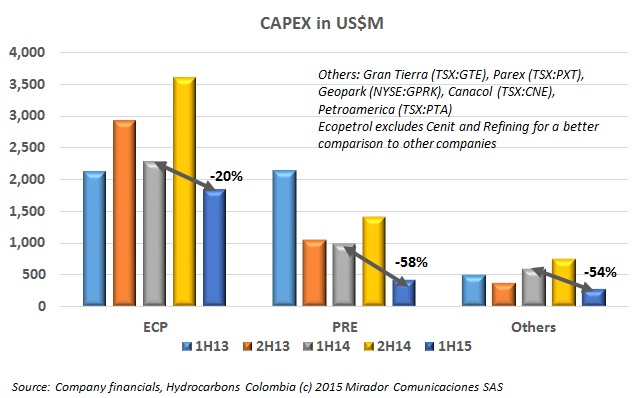

Yet another question from a subscriber on how Colombian E&P companies have reacted to the decline in oil prices. The answer for CAPEX is ‘fairly dramatically’ except perhaps for the NOC. And as the car-miles/gallon disclaimer says “Results may vary”.

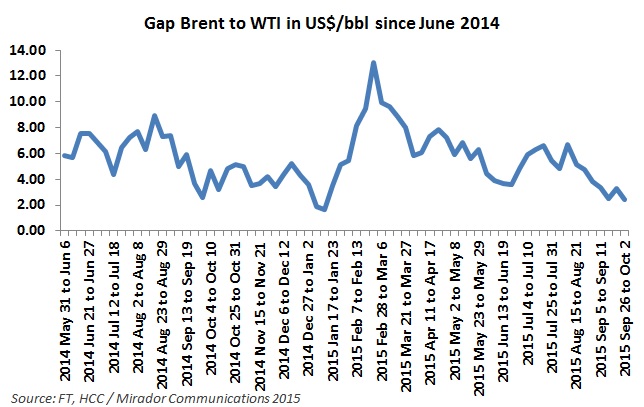

Ecopetrol is following the lead of other producers in Latin America and OPEC members by importing light crude from Nigeria and Russia to mix with its heavy crude production and fetch a better international price, fostered by a shrinking gap between the Brent and WTI prices.

The General Controller performed an audit of the Colombian Petroleum Institute (ICP), the research institute of Ecopetrol (NYSE:EC) and found 15 administrative findings, two fiscal and four “disciplinary” cases in its contracts worth a total of CoP$1.072B (US$370,000). Questions on an unsuccessful building of a butterfly sanctuary were also raised.

The attack on the Transandino Pipeline (OTA) in June of this year has been labeled the worst in Colombia’s history due to the extensive environmental damage which occurred from the spilled oil. Four months on, the initial emergency measures are just now being concluded.

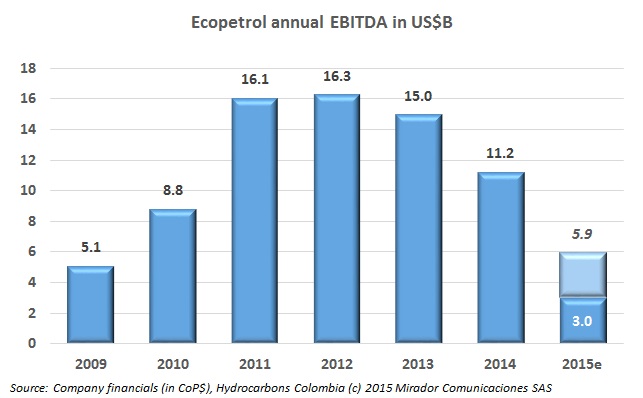

The benefits of peace on Ecopetrol’s (NYSE:EC) financial results, and in turn the fiscal take, are numerous; from the value of oil deferred or spilled due to attacks, repair costs of pipelines and production from areas where the conflict has prevented greater E&P activity.

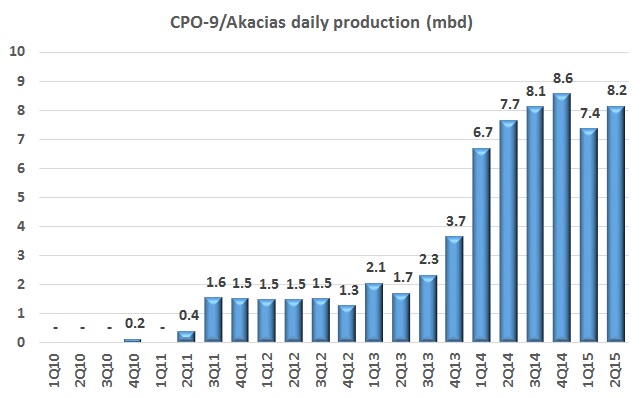

The process to clear the way for Ecopetrol (NYSE:EC) to start commercial production work for its CPO-09 block is slowly moving forward, while challenges persist for heavy crude production and its potential in Colombia.

Ecopetrol (NYSE:EC) environment chief for Middle Magdalena and Catatumbo Julia Celina Angulo Díaz said that the NOC will be recognized by the United Nations Development Program in December for its social work in the region.

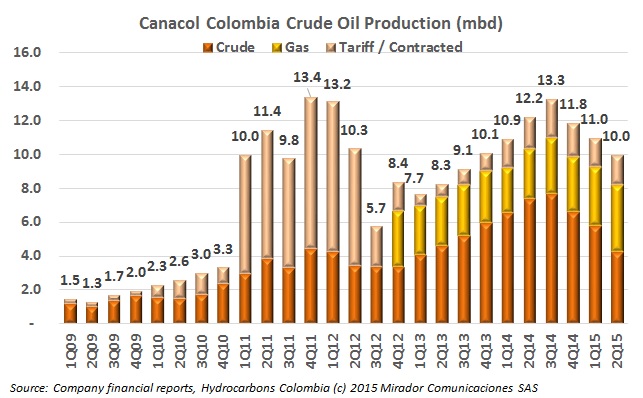

Canacol Energy (TSX:CNE) continues its transition to focus on gas production which outpaced crude production in the 2015 fiscal year, and in the quarter ending June 30 went up at the nearly same rate crude production went down. But its bottom line was hit by the fall in oil prices, resulting in a loss.