A bit of spin is to be expected when government officials address strategic projects, but Minister of Finance Mauricio Cárdenas took it to a surprising level and asserted that the Cartagena Refinery really did not have overruns, rather its high cost was the fault of Glencore’s poor estimations in 2006.

Coal miner Drummond says that it could receive its environmental license “at any moment” to start production of Coal Bed Methane (CBM) in La Guajira, where a concession dispute with the coal miner of the same block, Cerrejón had kept the project from moving forward.

Ecopetrol invests in improving educational infrastructure in Casanare, meanwhile the firm also promises the construction of a college campus in Granada. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry believes the main challenge of Colombia’s oil industry is to attract and maintain investment. And he stuck to the government’s game plan: that the best way to do this is through achieving peace, not lowering taxes on companies.

Ecopetrol (NYSE:EC) has been emphasizing its opportunities outside of Colombia and the president of its Brazilian unit, Joao Guilherme Clark said just ahead of the block auction last week it was interested in growing its participation in E&P blocks, but in the end made no bid to do so.

Ecopetrol (NYSE:EC) has confirmed that it has fired up its industrial services units at the Cartagena Refinery (Reficar), another step towards a full operational launch of the long-delayed project.

A combination of low oil price and attacks on oil infrastructure around the Tibú Municipality in Norte de Santander has led to accusations of mass closures by Ecopetrol that have affected around 1000 workers.

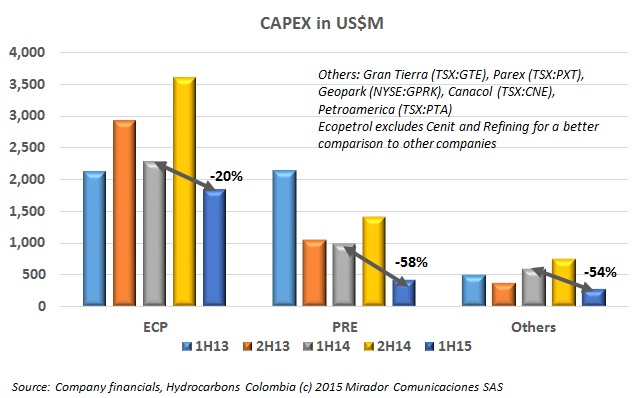

Yet another question from a subscriber on how Colombian E&P companies have reacted to the decline in oil prices. The answer for CAPEX is ‘fairly dramatically’ except perhaps for the NOC. And as the car-miles/gallon disclaimer says “Results may vary”.

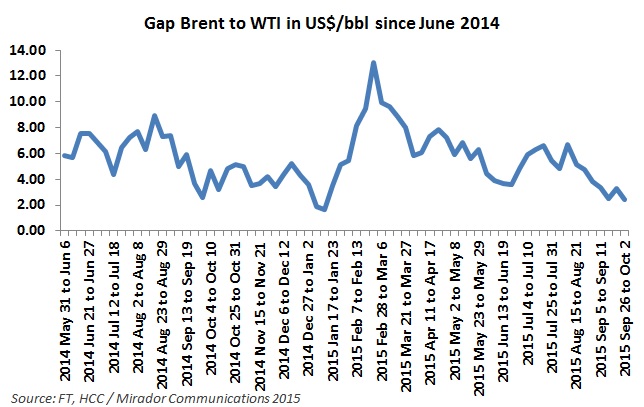

Ecopetrol is following the lead of other producers in Latin America and OPEC members by importing light crude from Nigeria and Russia to mix with its heavy crude production and fetch a better international price, fostered by a shrinking gap between the Brent and WTI prices.

The General Controller performed an audit of the Colombian Petroleum Institute (ICP), the research institute of Ecopetrol (NYSE:EC) and found 15 administrative findings, two fiscal and four “disciplinary” cases in its contracts worth a total of CoP$1.072B (US$370,000). Questions on an unsuccessful building of a butterfly sanctuary were also raised.