Pacific E&P’s management said in a recent interview that it is in strategic talks to find a long term solution to its debt payments, and that its robust operational portfolio could facilitate this discussion, but did not give more specifics.

Gas Natural Fenosa country manager for Colombia, Alberto González, said that the supply of natural gas is solid and that the firm will look to growth by introducing more gas-powered appliances in homes, and invest in infrastructure.

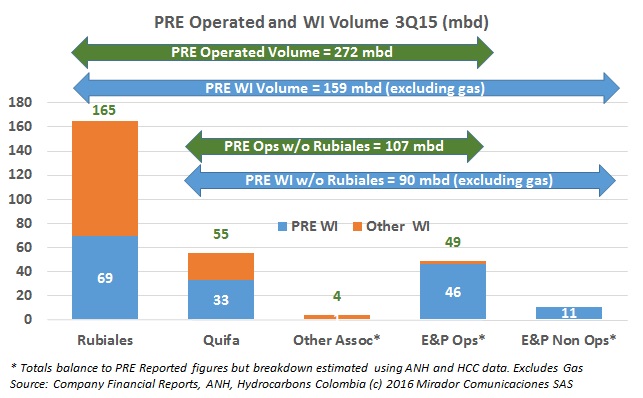

There is no avoiding the discussion: these days we cannot talk to anyone either in or outside of the industry without someone asking “What will happen to Pacific?” We cannot answer that nor we will we speculate. But we can provide some facts and estimates that we think illuminate the risks to total Colombian production in a ‘doomsday scenario’.

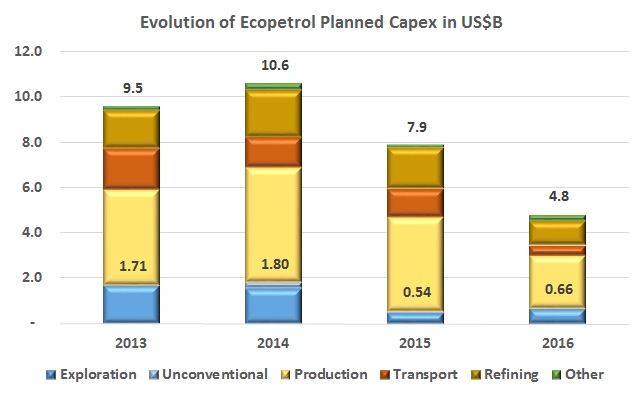

The Colombian Chamber of Oil Goods and Services (Campetrol) published an analysis of how Ecopetrol’s (NYSE:EC) exploration budget has shifted to market conditions over the last several years, and urged the NOC to step up exploratory efforts and spending.

The blame game is in full effect, and now the General Controller has said the Cartagena Refinery contractor charged with the cost laden modernization project CB&I (NYSE:CBI) is looking to pull out of Colombia without passing over documents requested by the control entity in an audit of the project.

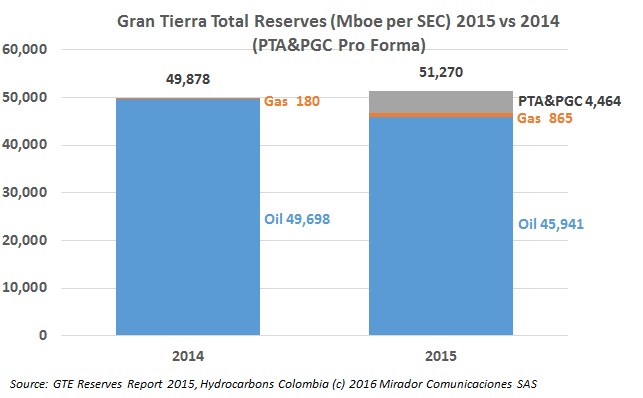

Gran Tierra Energy (TSX:GTE) CEO Gary Guidry reaffirmed the operator’s focus on Colombia, and said that with low prices many projects will no longer be viable, presenting an opportunity for firms with a low cost structure. He also emphasized the importance of oil infrastructure.

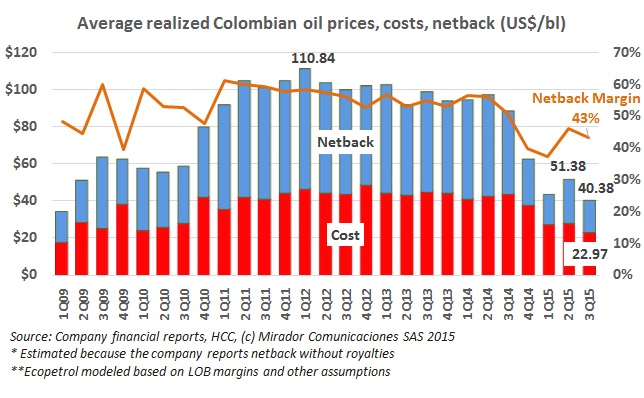

Speculation has risen in the local press that the high proportion of heavy crude in Colombia and Venezuela means that already operators are selling oil below the cost of producing it.

The General Controller has released a 200 page report on the cost overruns incurred in modernizing the Cartagena Refinery, and accused Ecopetrol (NYSE:EC) of spending US$4.02B more than the original budget.

Theoretically, lower oil prices mean some resources will cease to be economically viable and will have to be written down. “How much will be written down?”is a question that we frequently get asked. Gran Tierra (TSX:GTE) gives us first look, although it is a special case.

The USO said that its presence has been critical to support community residents in Monterrey, Aguazul and Tauramena who are protesting Ecopetrol’s decision to eliminate transportation for contractor workers, which it says is another sign of the NOC using the oil price crisis as an excuse to weaken worker rights.