We came across two profiles of recent executive appointments in Colombia which warranted a bit more attention: the arrival of Andrés Acosta as the new president of ExxonMobil (NYSE:XOM) Colombia, and of Felipe Bayón Pardo as Ecopetrol’s (NYSE:EC) COO.

Ecopetrol (NYSE:EC), Equion, and Parex Resources (TSX:PXT) have all been activie in the Llanos, as the new Governor promises to create a space to facilitate dialogue and reduce social conflict. These and other Corporate Social Responsibility (CSR) stories in our periodic roundup.

Ecopetrol (NYSE:EC) says that the fall in oil prices has forced it to suspend wells temporarily in the Caño Sur field, in Puerto Gaitán, Meta. A local operations manager said it has already filed the request with the National Hydrocarbons Agency (ANH).

Local authorities, unión leaders and sympathetic lawmakers have convened to call on the national government to declare a state of economic emergency in Barrancabermeja and to write a strategic Conpes document, looking at Ecopetrol (NYSE:EC) to compensate for canceling its plan to modernize the local refinery.

After having cut CoP$2.8T from operating costs in 2015, Ecopetrol (NYSE:EC) announces further cuts for 2016 which are expected to save CoP$1.6T (US$0.5B).

It was already burning, and you should not blame the firefighters, said Ecopetrol president Juan Carlos Echeverry in response to questions regarding the role of current ministers and government officials in the overruns of the Cartagena Refinery. This and other stories in our update on this matter.

The director of the National Planning Department (DNP) and Ecopetrol (NYSE:EC) board member Simon Gaviria says that the NOC is preparing a dividend proposal that looks to protect its investment grade rating, and avoid being classified as a junk.

Alarms from environmental groups in Casanare has put a seismic campaign planned by Canacol Energy (TSX:CNE) into a firestorm of controversy over a permit to extract water from the Cravo Sur River.

The controversy surrounding the soaring costs to modernize the Cartagena Refinery (Reficar) has hit new heights (or are they lows?), with control bodies promising to investigate former management, presidents accusing presidents and much more.

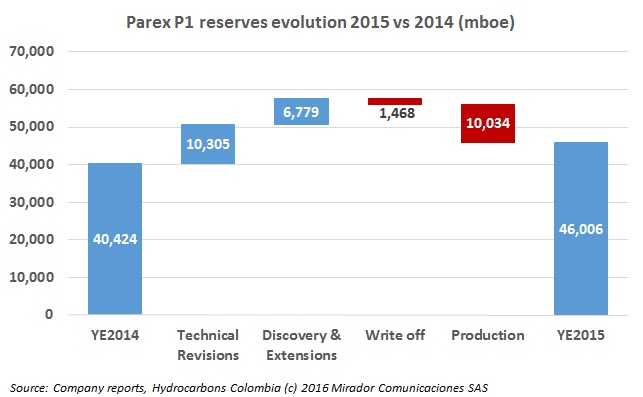

Parex Resources (TSX:PXT) reported its 2P reserve assessment for 2015, and said that it grew its proved plus probable reserves by 19% year-over-year, to log net 2P reserves of 81.7Mmboe as of December 31, 2015.