Equion Energy received accolades for a program in which it hired demobilized combatants as part of a transitional initiative. This and other Corporate Social Responsibility (CSR) related news in our periodic summary.

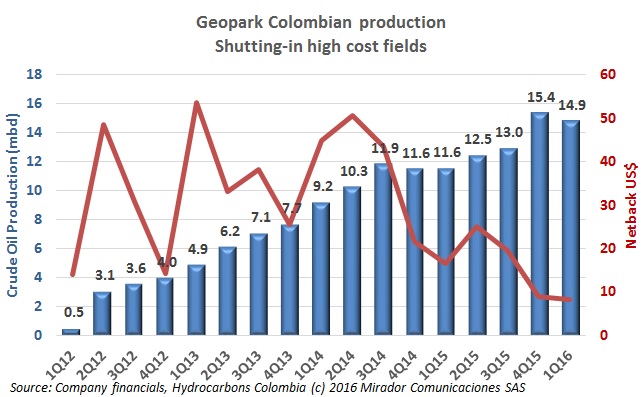

Geopark (NYSE:GPRK) will explore “every piece” of its Llanos 34 block, but does not want to stop there. Its Colombia director Marcela Vaca gave details on its exploration activities, and that it has interest from larger operators and investment funds to form joint ventures.

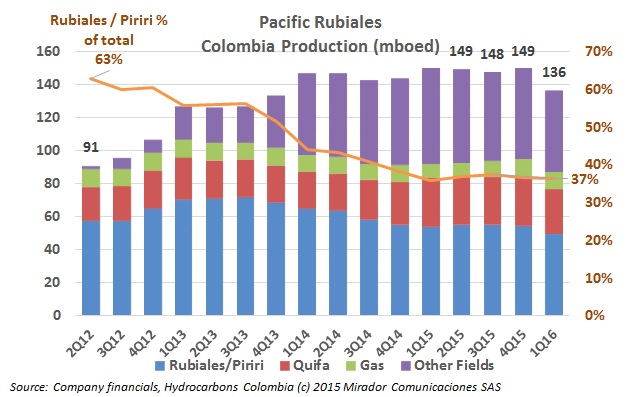

Pacific E&P posted a US$901M loss in the first quarter of 2016 and saw its production fall as well. In its earnings statement issued on May 13th, management seemed set on accepting a restructuring deal from Catalyst Capital.

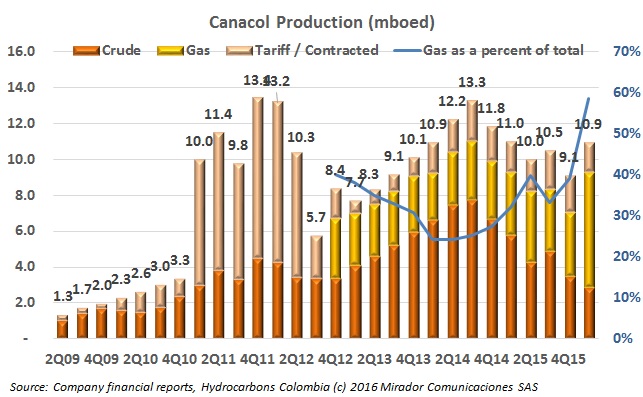

Canacol Energy’s (TSX:CNE) strategic direction towards greater gas production helped it defy the general trends of its peer: Netbacks and revenues rose, costs fell, and it even reported a profit for the first quarter of 2016.

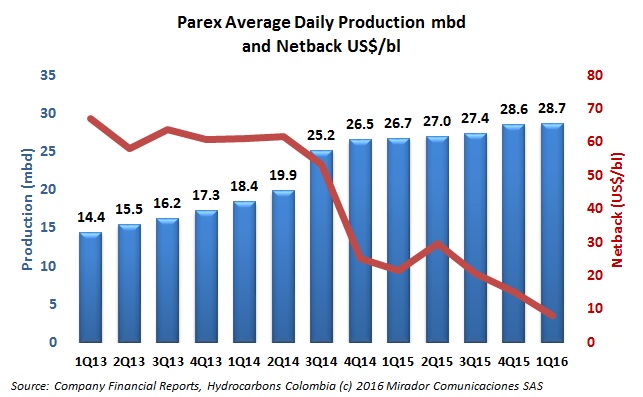

Parex Resources (TSX:PXT) said that its 1Q2016 production grew 8% year-over-year to 28,900boed, and that oil prices are reaching a point where it can consider increasing its 2016 Capex spending.

Equion Energy president María Victoria Riaño credited cost cutting measures and efficiencies for helping maintain the company’s financial performance and production, allowing it to beat the expectations of its two shareholders Ecopetrol (NYSE:EC) and Repsol (MSE:REP) and deliver dividends worth US$190M in 2015.

The fall in prices and a drying market for exploration-related services have hit small service firms particularly hard. But it is the high burden of taxes that could deliver the fatal blow.

Geopark (NYSE:GPRK) said that its production grew 15% in the first quarter of 2016 to reach 22,518boed compared to the previous year, but its revenues suffered from discounts to global prices in Colombia.

The back and forth accusations continue between Pacific E&P management and a group of minority shareholders after the company accepted a restructuring offer from Catalyst Capital, but a new offer from EIG Global Energy Partners has emerged at the last minute.

The National Hydrocarbons Agency (ANH) says that it has detected a significant increase in the buying and selling of E&P blocks, provoked by the fall in oil prices.