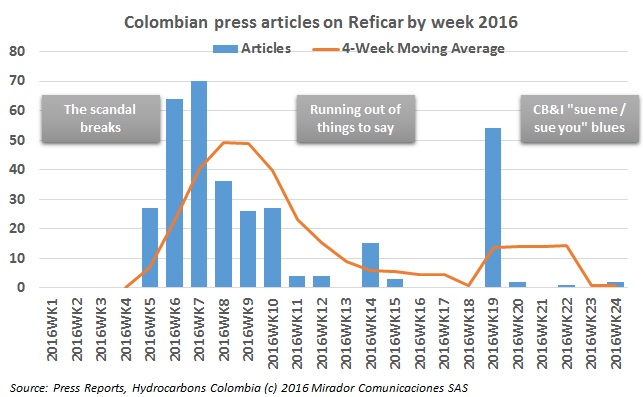

The scandal surrounding the Cartagena Refinery (Reficar) might have fallen to a secondary status, but continues to make headlines. A Senate hearing last month, accusations of environmental damage and a full audit by the General Controller’s office have all taken shape over recent weeks.

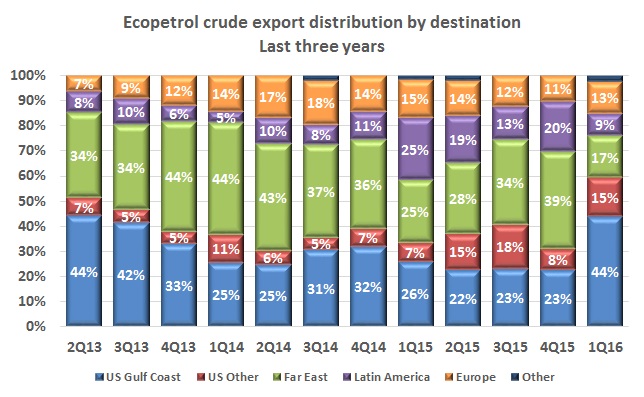

Ecopetrol’s (NYSE:EC) export distribution in 1Q16 showed a big shift to the US, the Gulf Coast in particular, and away from the Far East, which had been a strategic market for the NOC.

The restructuring process of Pacific E&P will take place in the Canadian legal system after both US and Colombian authorities announced they would support this process, although Colombian regulators have ordered the firm to guarantee payments for its Colombian creditors.

Despite assurances from leaders of the UTEN oil workers union, which affiliated Pacific E&P workers in the Rubiales field, Ecopetrol (NYSE:EC) has confirmed it will not use the UTEN workers, it will hire a completely new workforce, in a victory for the more militant USO union.

Ecopetrol (NYSE:EC) is set to receive the Cusiana field from Equion on July 4th, and is in talks with the local community to identify social priorities which are aligned with the project.

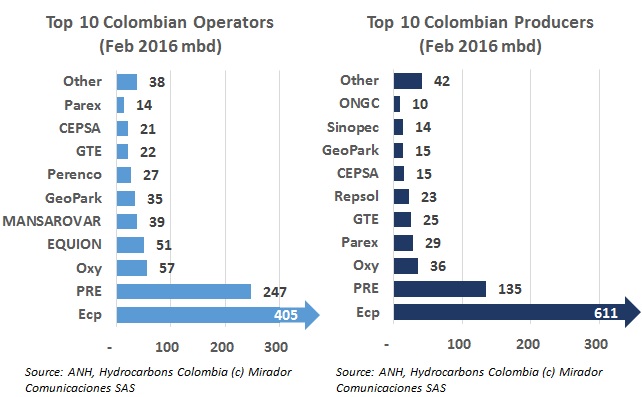

Last week we did the top 10 oil producers so we thought we would start this week off with the top 10 gas producers and then look at the top 10 combined producers.

Ecopetrol (NYSE:EC) has signed an agreement with communities which affected its production in Chichimene, in the Acacías and Castilla la Nueva Municipalities, but reports show a willful criminal activity behind the protests, which could flare up again.

Senator Fernando Araújo pointed out the benefits that the modernized Cartagena Refinery (Reficar) has contributed and will bring to the local community, and called for specific investments to mitigate faulty infrastructure in the nearby communities.

Juan Carlos Echeverry, Ecopetrol’s (NYSE:E) president, said in an interview that the NOC has been going through a deep cultural change prompted by the fall in oil prices. Local hiring, community relations, the ability to “sacrifice barrels” and environmental matters are some of the areas affected.

We have not done this graph for a while but a recent newspaper article which we thought was misleading inspired us to do it.