Following accusations from the retail fuel station association Fendipetróleo that Terpel is taking advantage of its status as a wholesaler and retailer of fuel to crush small businesses with an unfair advantage and low prices, the firm’s president Sylvia Escovar responded.

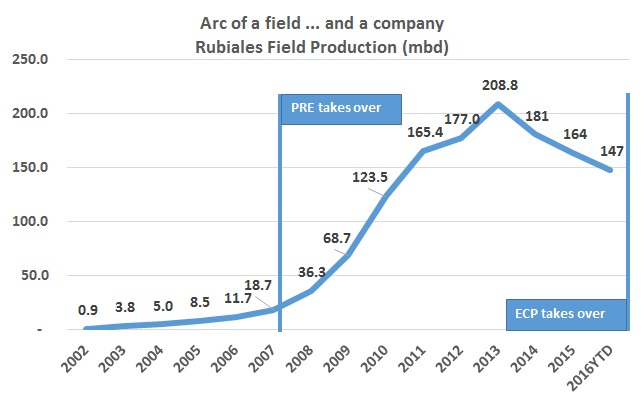

Reduced drilling times, an efficient use of personnel and new technologies tested in other fields are some of the goals that Ecopetrol has put in place to reverse a declining production trend in the Rubiales field, according to its VP of production Hector Manosalva.

Ecopetrol (NYSE:EC) has applied for modifications to its environmental licenses to drill new wells in the vicinity of Barranca. It has met with residents from 120 area villages to socialize the changes and impact it could have on the community. Municipal authorities say they will verify the work.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry took to the press to talk about the NOC’s plans and challenges in the Rubiales field, and addressed other big issues like the Propilco sale, Bioenergy, and more

Ecopetrol has announced that two of its high executives will swap roles. Thomas Rueda, current president of the NOC’s transportation firm Cenit, will take over as president of the Ocensa pipeline, while the pipeline’s president, Luisa Fernanda Lafaurie, will take the Cenit role.

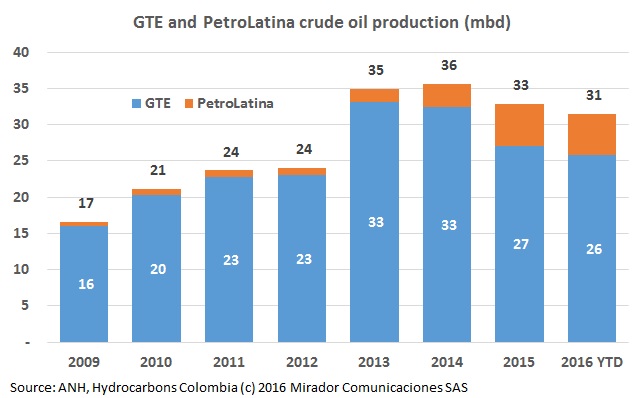

Gran Tierra (TSX:GTE) says that it has closed a US$525M deal for PetroLatina Energy, as it consolidates its position in Colombia and in the Middle Magdalena basin.

As we write this the Rubiales field is hours away from being reverted to Ecopetrol (NYSE:EC), marking the end of an era for Pacific E&P. Starting at 12am on Friday, July 1, the NOC will be tasked with taking the field over, and plans to start a new drilling effort to maintain its declining production level.

The other major reversion (besides Rubiales), Ecopetrol (NYSE:EC) is set to receive the Cusiana field on July 4th, after the end of the Tauramena association contract, signed originally between BP (NYSE:BP) and Ecopetrol in 1986.

Equion Energy held a farewell activity as it closes its contract for the Cusiana field and thanks the community and authorities. But in Nunchía, blockades at its Floreña I well have it close to suspending operations. These and other Corporate Social Responsibility (CSR) related stories in our periodic summary.

Accusations of unfair competition, of a monopoly and aggressive tactics against family-owned fuel stations have made press, with a particular emphasis on Terpel, which critics say has crossed a line as a wholesaler and retailer.