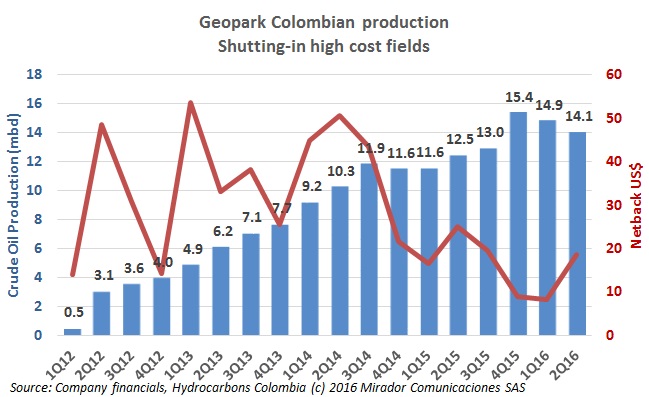

After successive production growth, Geopark´s (NYSE:GPRK) oil and gas production dropped for the first time, but the firm was able to shrink its loss compared to the first quarter and last year.

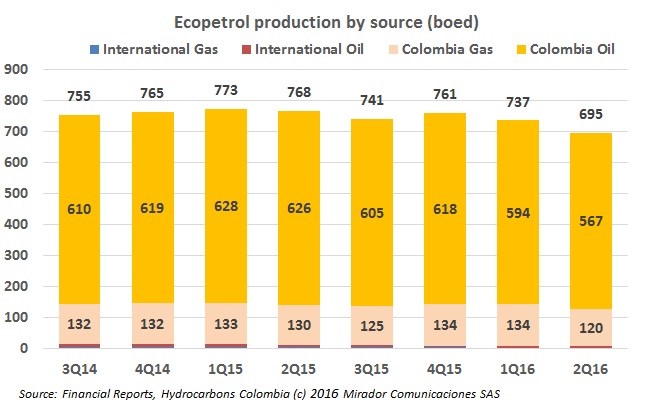

As Ecopetrol (NYSE:EC) closed an intense six months which included the operational launch of the Cartagena Refinery (Reficar), the handover of Cusiana and Rubiales and a management restructuring. The firm reported that during the second quarter its production has faltered but its financial results improve on the first quarter of the year.

Ecopetrol (NYSE:EC) has started the process of naming a new president for the Cartagena Refinery, with an international headhunt expected to bring an executive with precise knowledge of the petrochemical market and refining operations.

Ecopetrol (NYSE:EC) has announced that the Gunflint field has started producing 20,000bd, of which its US subsidiary has a 31.5% share, and the NOC highlighted the strategic nature of this sort of asset.

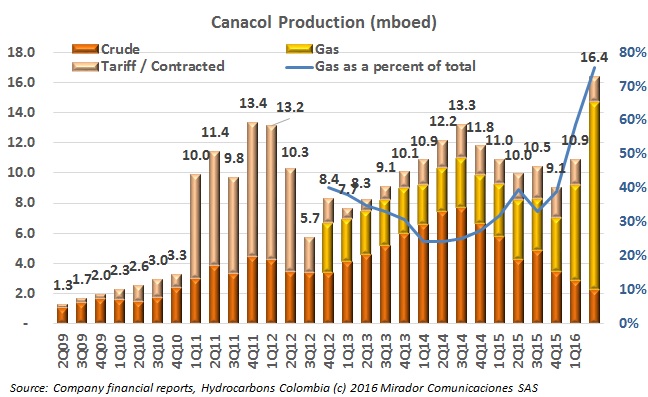

Canacol Energy (TSX:CNE) said that its second quarter 2016 production and revenues have set a corporate record as it posted double digit growth and consolidated its offer of natural gas.

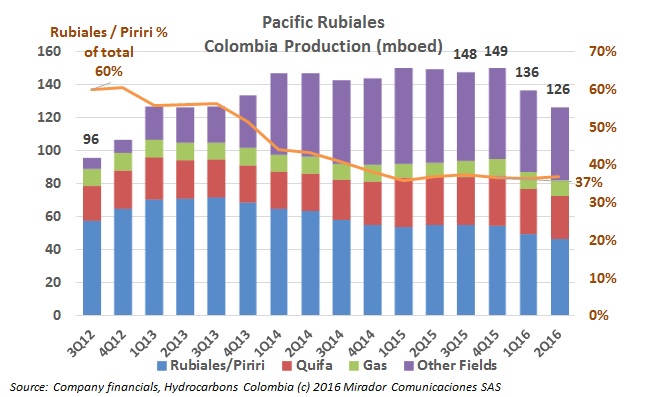

Pacific E&P published its second quarter 2016 results, which saw a decrease in production and revenues as the firm’s future awaits its ongoing restructuring process. These results marked its last quarterly report that will include the Rubiales field.

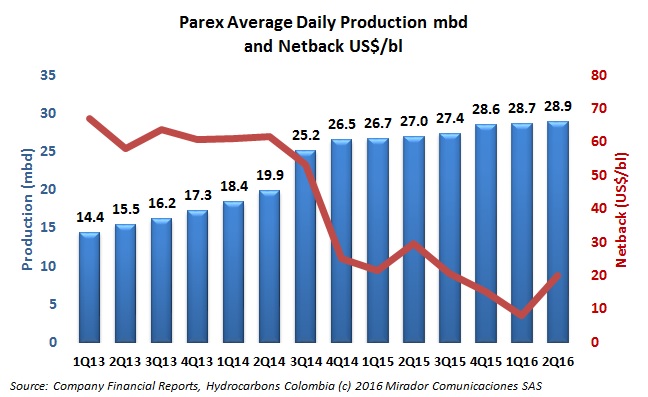

Parex Resources (TSX:PXT) saw a slight sequential increase in oil production during the second quarter of 2016, and shrunk its loss, nearing the breakeven point.

Colombia’s central bank updated its official numbers for Foreign Direct Investment (FDI) in the petroleum sector and there is good news and bad news.

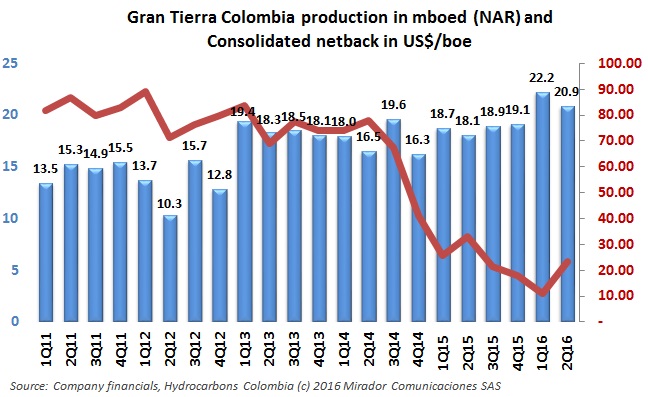

Gran Tierra (TSX:GTE) second quarter 2016 production held, and the firm said that it has deferred planned workovers to the second half, and expects improvements in the oil price to continue. The second half will also include contributions from the recent acquisition of PetroLatina.

Ecopetrol (NYSE:EC) has proposed moving its Lorita-1 well, part of an exploration project, due to concerns from residents in the Municipality of Guamal, Meta. The NOC said that the project will go forward, although it has been discussed now for over three years.