Ecopetrol (NYSE: EC) has been strengthening its transport business in recent years. The Colombian company has great plans for this corporate area since it has become one of the most profitable.

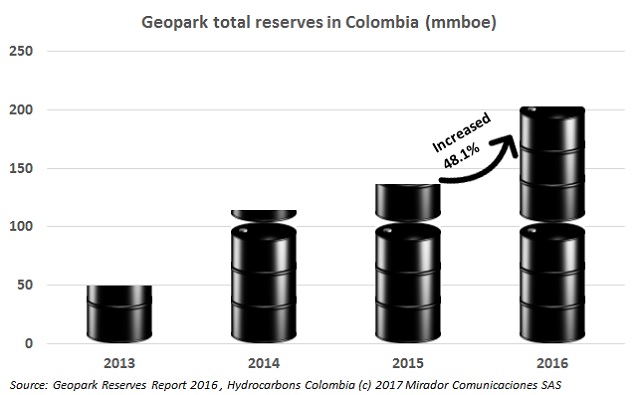

Geopark (NYSE: GPRK) announces record oil and gas reserves. The data was certified by DeGolyer and MacNaughton (D&M) as of December 31, 2016.

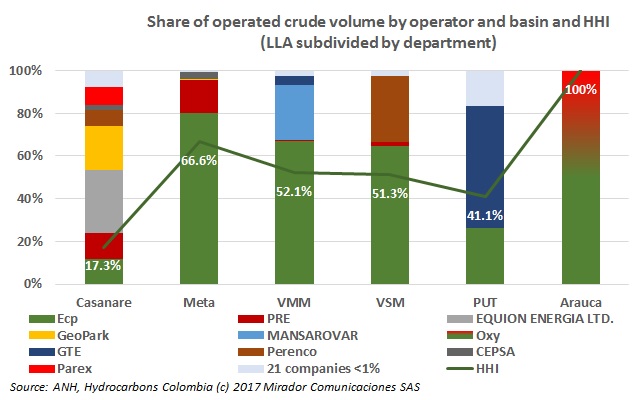

This week’s “From our Analyst’s Desk” deals with market concentration, an economic concept regulators use to decide if there is or is not sufficient competition in an industry. That was a Colombia-wide view. Here we break down the results by basin.

Pacific Exploration & Production Corp. (TSX: PEN) announced the appointment of Barry Larson as new CEO. The company´s new head will start working February 20, 2017.

Colombian media reported the country has one of the most expensive production processes in the world.

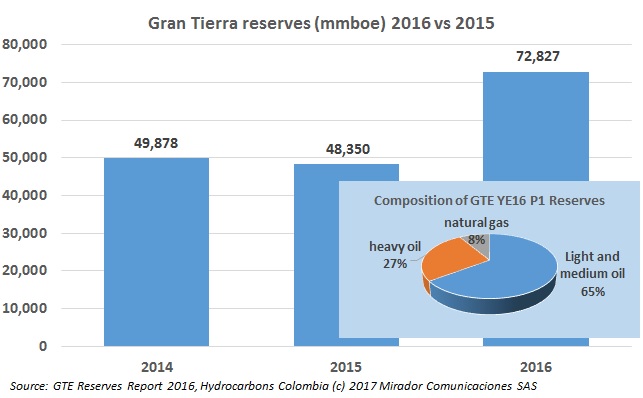

Gran Tierra (TSX:GTE) is first out of the gate for Colombia-focused companies with its year-end 2016 reserves report. The growth was substantial, helped by higher oil prices, exploration and acquisitions.

W Radio reports that the National Agency of Environmental Licensing (ANLA) denied an environmental license to Gran Tierra Energy (TSX: GTE) for exploratory work in Orito, Putumayo.

After the report presented by the Office of the General Comptroller on CBI and Reficar’s contracts, there are “more questions than answers.” According to the Colombian press there would be a loss to the nation of CoP$8.5T, but the presumed cost overruns should be examined in detail.

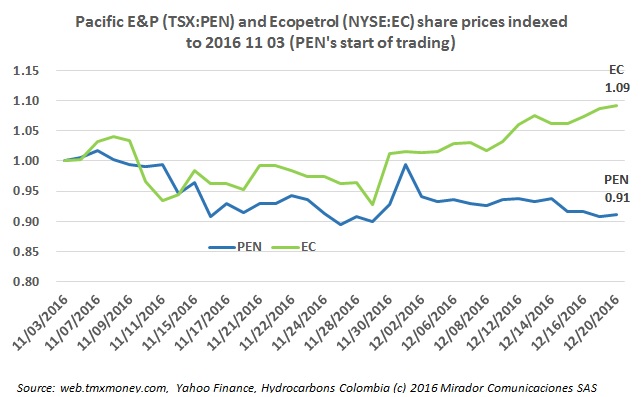

Pacific Energy (TSX:PEN) is closing 2016 in much better shape than it started, and following its nearly yearlong process of crisis and restructuring, is valued at just over US$2B based on current market figures. But investors are still wary of the firm’s shares.

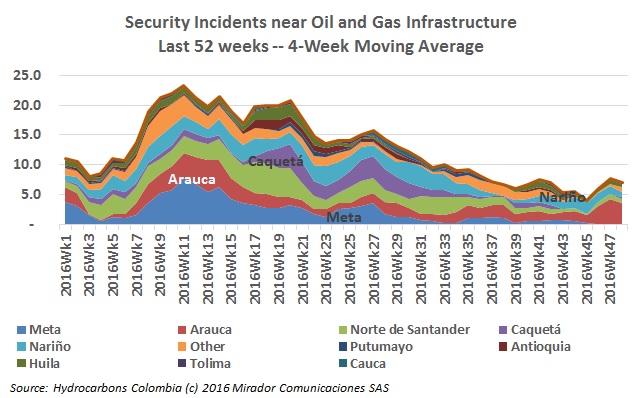

Now a larger problem than attacks on pipelines or facilities, the illegal drug and mining trade and groups linked to the ELN guerrilla which steal crude using illegal valves has become one of Ecopetrol’s (NYSE:EC) primary concerns, and the activity also damages the ecosystem.