Ecopetrol (NYSE: EC) announced its operating strategy for this year. Unsurprisingly, the company wants to continue generating short-term profits for its shareholders.

The oil industry has contributed to the country’s development, but also provokes rejection by some. Juan Carlos Echeverry, CEO of Ecopetrol (NYSE: EC), referred to this situation and said that the country must make a decision.

Our count of security incidents near oil and gas infrastructure that we attribute to the guerrilla went down this month. But considering the impact, mere numbers are not telling the whole story.

Ecopetrol (NYSE: EC) announced that it has found oil in the municipality of Rionegro (Santander). The company said that the well has a strategic position, suggesting more is to come.

The Corporate Reputation Business Monitor (Merco) and the Department for Social Prosperity (DPS) ranked the companies most-committed to social investment in Colombia. Pacific (TSX:PEN) was the industry’s leader on the list, at number 15.

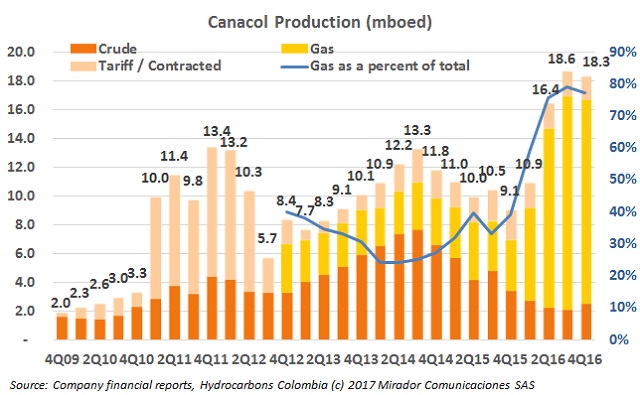

Canacol Energy Ltd. (TSX: CNE) announced its financial results for last year. The company achieved its production goal, made several new gas discoveries and reported an increase of gas sales. Company´s prospects for 2017 are optimistic.

In the past year, the gas sector invested CoP$1.2T to maintain the natural gas and electricity supply in the country.

Ecopetrol (NYSE: EC) wants to increase its gas production and the firm is looking for strategic alliances. The NOC will have a meeting with the Malaysian company Petroliam Nasional Bhd (Petronas).

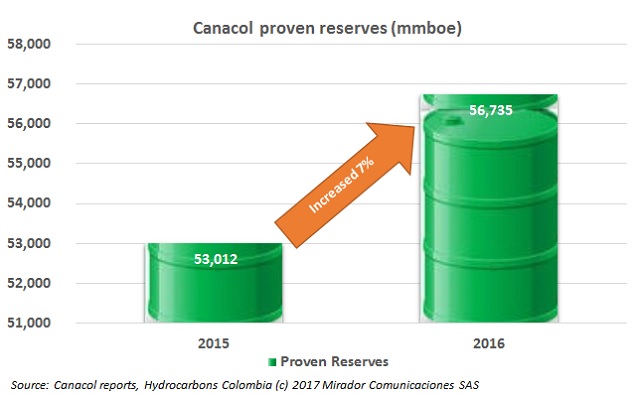

Canacol Energy Ltd. (TSX: CNE) reported its reserves volumes for 2016. The company is present in Lower Magdalena Valley, Llanos and Middle Magdalena basins in Colombia.

Amerisur Resources Plc (LON: AMER) announced asset acquisitions in the Caguan-Putumayo Basin. The blocks were bought from Pacific Energy E&P (TSX: PEN).