Frontera Energy Corporation (TSX: FEC) announced updates to some of its transportation contracts in Colombia, generating huge savings for the company. However, this has generated a controversy because CENIT has announced actions against FEC.

Geopark Limited (NYSE: GPRK) announced its operational update for the three-month period ended June 30, 2018 (“2Q2018”). The company reported good production performance and successful drilling activities in the Llanos 34 block during this quarter.

Eric Flesch Santoro was appointed by Promigas’ Board of Directors as the new president of the company, a position that he will occupy as of September 1st, 2018.

The NOC spoke about successful social investment projects in Santander, Putumayo and Meta. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

Industry companies took the stage at this year’s International Environment Fair (FIMA), to talk about their challenges and accomplishments in their areas of influence.

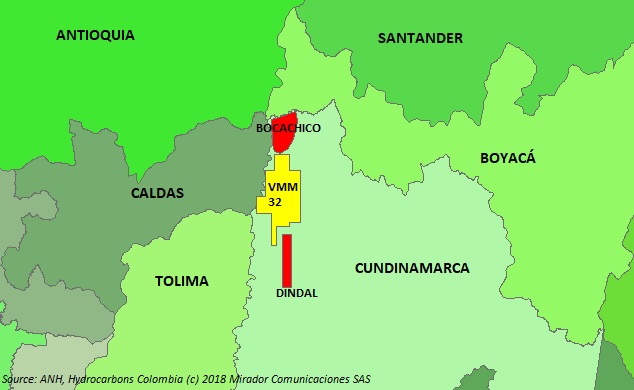

Ecopetrol (NYSE: EC) continues to develop exploration activities in Colombia and it seems like the strategy is on the right track. The NOC announced a new discovery in the department of Cundinamarca.

Colombia’s Federation of Insurers (Fasecolda) presented a proposal to sell the government’s shares in Ecopetrol. The initiative was not free from controversy.

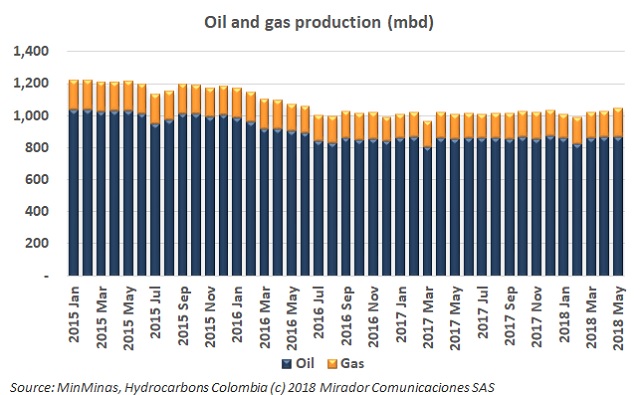

The country showed a decrease in its economic growth in 2017, but the recovery of oil prices has generated positive expectations for this year. Juan Manuel Santos, President of Colombia, could end his administration with signs of economic recovery.

Oil companies have to face many challenges to operate in Colombia, while other countries in the region open their doors with attractive conditions and it seems like Mexico is attracting the interest of several companies operating in Colombia.

There is always something to be worked on to improve the sector’s performance. The issue of transportation costs has come up again so we thought we would reprint this chart from a few months ago.