Terpel completed 50 years of operation recently and its president Sylvia Escovar spoke about the company’s plans, challenges and projects in the country and other relevant issues.

Ocensa, Repsol (MSE: REP) and Equion updated on the development of successful social investment projects in their areas of influence. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

The government announced that the savannas of Cinaruco (Arauca) are now part of the list of protected areas in Colombia. The development of these and more stories in our periodic Eco summary.

The firm won the Latinoamerica Verde (literally: ‘Green Latin America’) Award, for its successful environmental compensation project in Casanare.

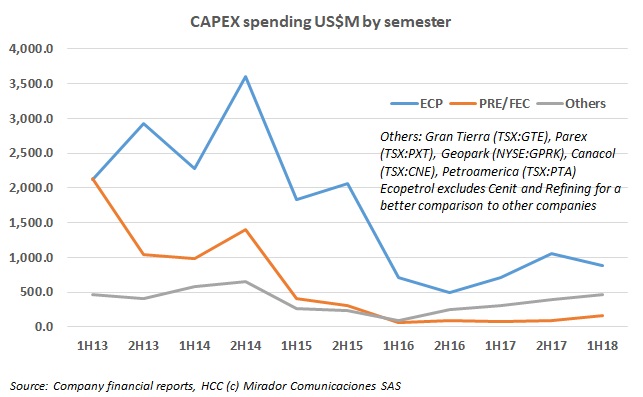

There was considerable debate among industry watchers about whether companies spent the Capex they expected to in the first half of 2018 or held the money back. As usual every case is different – and we had to make some assumptions — but it looks like they spent as expected or more, except ECP.

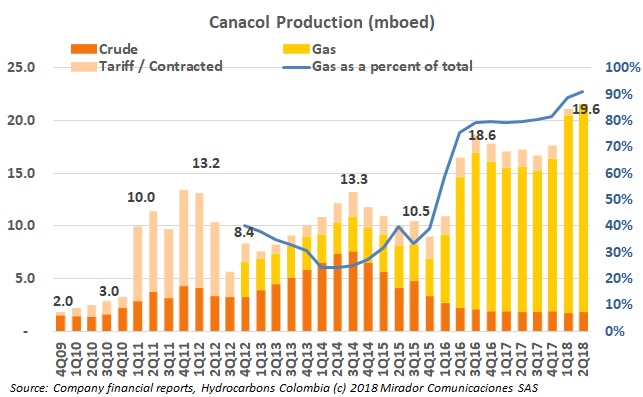

Canacol Energy (TSX: CNE) announced its financial and operational results for the three months ended June 30, 2018. Average production increased, but the firm reported a net loss during this quarter and 1H18 (due to one-time and non-cash charges).

Julio César Vera, president of the Colombian Association of Petroleum Engineers (Acipet), spoke about the importance of fracking to assure the country’s self-sufficiency.

Oil companies are diversifying their portfolios and the industry associations say the petrochemical business has positioned itself as one of the most attractive alternatives.

Ocensa, Geo Park (NYSE:GPK) and Ecopetrol (NYSE:EC) spoke about the successful development of social investment projects in their areas of influence. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

The company announced measures to improve its service in the Colombian Caribbean.