The U’WA indigenous group, who has been blocking access of repair crews to damaged sections of the Caño Limón – Coveñas pipeline, skipped a meeting scheduled for April 18th with the national government and say they will only meet for a previously established roundtable on the 25th. Meanwhile, the pipeline remains out of service.

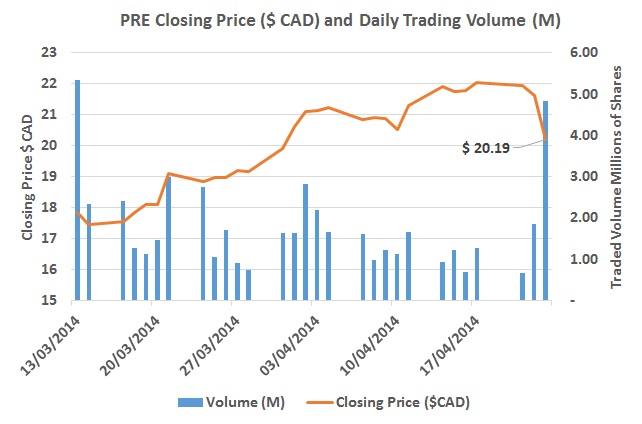

Unusual seismic readings in the company’s most important territory of Puerto Gaitan, Meta and a 1Q14 operations update saying that the company’s largest field, Rubiales, will have lower production again this quarter seem to have spooked investors.

Small diameter pipeline says it has added a line of informative sessions in addition to those required for its environmental permit and completed a diploma course that it sponsored for communities in the area of influence.

The Colombian Petroleum Association (ACP) says that it expects 140 exploratory wells to be drilled in 2014, a number which is 20% above its total for last year but well below lofty projections from the National Hydrocarbons Agency, which expects 233.

In Huila and Putumayo, the number of tankers on the road has dropped by 40% since an announcement three weeks ago from President Juan Manuel Santos that pipelines would be used instead of trucks when possible to reach the Tumaco port.

The Monterrey municipal council says it will go ahead with a public referendum to accept or reject oil exploration and production near the municipal water resources despite warnings and court rulings that this task is reserved for the national government.

Proposals for reorganizing how hydrocarbons are transported, everything from an integration of large trucking firms to optimize use, to trains and to harnessing the Magdalena River have all been proposed over the last week.

Despite higher average temperatures and droughts in regions such as Casanare, authorities say that the national energy grid should have no problem covering energy demand from hydroelectric dams, even if rainfall over the next couple of months is lower than expected.

Rain has reached Casanare’s Paz de Ariporo alleviating the ongoing drought which has affected the local community. But officials are now warning the rain could lead to widespread water contamination due to the high amount of animal carcasses, and accusations that the oil industry is at fault for the situation continue to fly.

Incidents near areas of interest to the oil and gas industry were up to 39, above recent and long-term averages. Non-Armed-Forces-reported incidents were slightly above average in percentage terms and in absolute terms. This is our indicator of increased guerrilla-initiated activity. Our 4-week Moving Average incident count was up correspondingly at 36.3 and the 52 week average was up slightly at 31.3 incidents per week.