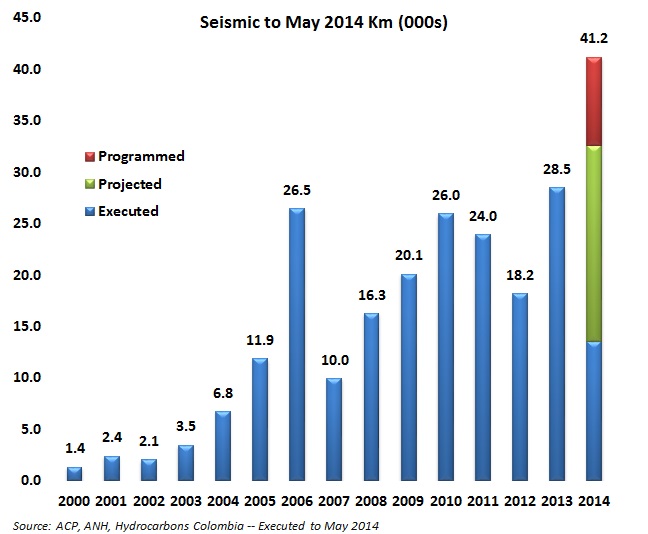

Year-to-date May 2014 results for kilometers of seismic and numbers of exploratory wells show improvement over 2013 but are not on track to meet government objectives.

Major changes are taking place in the NOC’s organization, at least on paper, moving some power away from the presidential suite.

With President Juan Manuel Santos’ reelection an item of the recent past, the peace process rambles forward. Whether or not the new found pace and inclusion of the ELN guerrilla will hold is now our big question.

As newly reelected President Juan Manuel Santos finishes celebrating, the hangover is probably starting to settle in. He may not even remember all the promises he made as the campaign got tougher but he soon will and voters will certainly remind him.

With US$6B in 2013 sales, gasoline retailer Terpel is the second largest company in Colombia by sales after Ecopetrol (NYSE:EC). It is in the middle of a transformation both of its gas stations and its corporate structure.

With the title “Fracking vs clean development mechanisms” a Llanos Internet news site tries to cover all the sides of the water issue but ends in a predictable conclusion.

In separate press articles, the leader of the natural gas industry association (Naturgas), Eduardo Pizano and the head of the electrical generation industry association (ANDEG), Alejandro Castañeda look to reassure consumers that supply will not be affected in the coming dry season.

In the run up to the 2014 Round auctions in late July, the head of the National Hydrocarbons Agency (ANH), Javier Betancourt, and the Vice-minister of Mines and Energy, Orlando Cabrales, have been talking to the press.

The General Manager of Llanopetrol, Ricardo Rodríguez Henao, sees a rapid timetable for the Meta micro-refinery project.

Despite a self-imposed truce by the Farc in the run-up to the second round of the Colombian presidential elections, security incidents near oil and gas infrastructure went up to 34 this week, at recent but just above long-term averages.