The Ministry of Mines and Energy (MinMinas) has signed a cooperation agreement with its counterpart in Peru to promote an exchange of information and hold a yearly meeting to discuss hydrocarbons development.

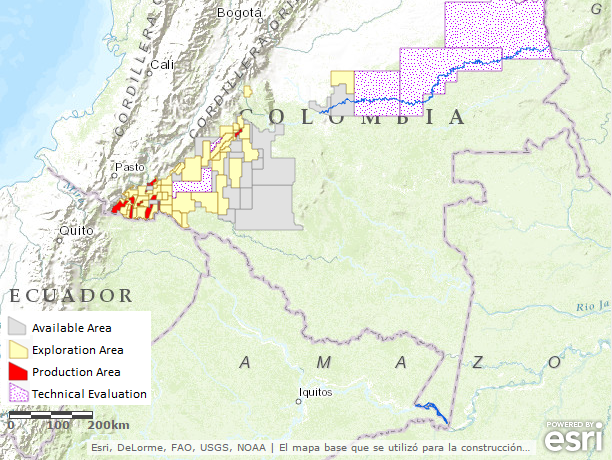

The National Hydrocarbons Agency is making slow advances towards the Amazon basin, which has the potential to greatly increase the country’s proven reserves, but could also ignite conflicts over environmental issues.

Senator Juan Diego Gómez, of the conservative party, wants to hold a debate in the Senate’s Fifth Commission on the issue of fuel quality to analyze issues surrounding Ecopetrol’s (NYSE:EC) refining of fuels in Colombia.

Perenco says that illegal blockades at its La Gloria Station in Aguazul Casanare have forced it to close its operations in the area.

The count decreased to 32 this week, well below recent and long-term averages. But we believe the reason was not decreased guerrilla activity.

Hours before a strike by USO-affiliated workers with Ecopetrol’s (NYSE:EC) biofuels refiner Ecodiesel, the union and company reached an agreement and averted the strike.

This week the back and forth between President Juan Manuel Santos and Senator, former President Alvaro Uribe continued after the later issued a statement with “52 capitulations” that he says Santos government is making.

A kind of class action lawsuit, or “Popular Action” has been verified Casanare Administration Tribunal after a public hearing late last week, in which Ecopetrol (NYSE:EC) has been required to install a valve for its natural gas line to the Agauazul municipality.

A recent seminar held by the Casanare Controller included addresses from two individuals with polar opposite views on the impact of seismic issues and the oil industry in general. The general public went one particular way with their comments.

Pacific Rubiales (TSX:PRE) and Belgian sea shipping logistics firm have signed an agreement to move forward with a natural gas liquefaction barge that could develop new markets for PRE and Colombia’s gas business.