Cenit, a subsidiary of the Ecopetrol Group, announced it will maintain the suspension of operations of the Trasandino Pipeline (OTA) following a detailed assessment of the security and environmental conditions in Nariño and Putumayo, where the pipeline is located.

NG Energy International Corp. (TSXV: GASX) announced a key decision on its Sinu-9 block.

The Colombian Association of Petroleum Engineers, Energy, and Related Technologies (ACIPET) expressed concern over delays and potential setbacks facing the Komodo-1 well project.

Last week we wrote our annual Fearless Forecasts article which focuses on the quantitative. But we also talk about the policy environment, really about politics and that proves especially important in the runup to elections in 2026. Readers ask us frequently about what comes next after August 7th, 2026. We realized that the topic deserved an analysis of its own.

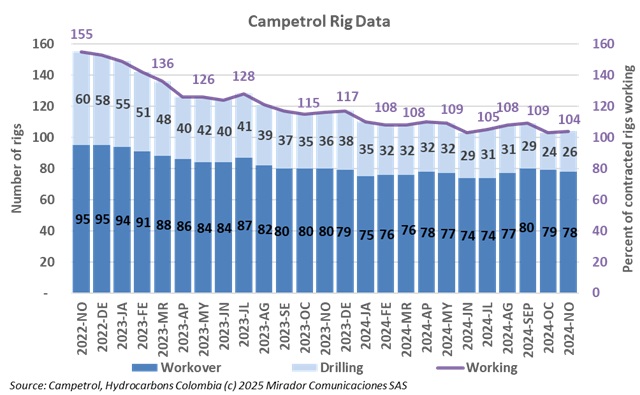

The Colombian Chamber of Goods and Services (Campetrol) reported rig information for November 2024.

Brookfield, the Canadian multinational managing Isagen, accused the Colombian government of violating international treaties.

The National Environmental Licensing Authority (ANLA) confirmed that the Komodo-1 gas project, a key initiative for Colombia’s future gas self-sufficiency, is facing delays due to appeals filed against its environmental license.

A proposed policy by Colombia’s Ministry of Trade (MinComercio) could significantly impact the freight transportation sector by increasing tariffs on vehicles, tires, and spare parts by 10% to 20%.

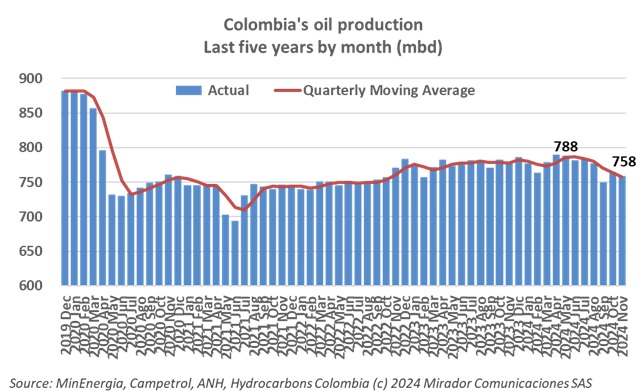

Crude oil production was up slightly in November of this year, according to the figures posted on the ANH’s website.

Ecopetrol (NYSE: EC) joined forces with AIQ, an Emirati multinational, to accelerate the energy transition and integrate artificial intelligence (AI) into their operations.