The Attorney General Eduardo Montealegre sparked a debate this week after he said that a referendum to approve an eventual peace agreement is not necessary, not from a constitutional nor legal standpoint. Instead the government has the power to pass the agreements as a Public Order Law, a power which was renewed by congress last year.

The Colombian Petroleum Association (ACP) says that the impact on E&P activities due to the fall of oil prices will start to make a strong impact on daily crude production, which will likely start to decline in 2016.

The Ministry of Mines and Energy (MinMinas) says that the market manager chosen to track and report on the transactions and operations of natural gas to improve negotiations between the supply chain is up and running.

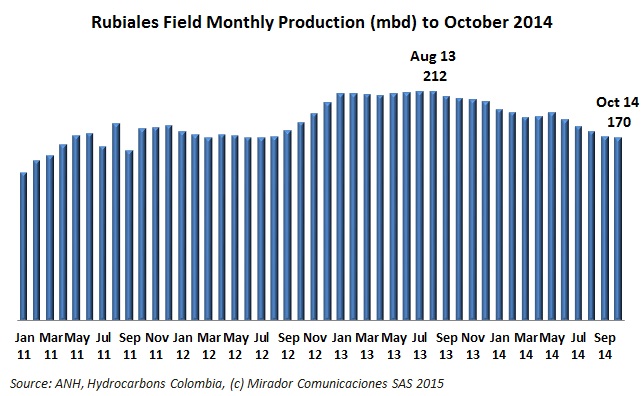

This article is not about Pacific Rubiales (TSX:PRE). It is about Colombia’s most productive field and the challenges of maintaining the 1mmbd goal.

Colombia’s national training agency (Sena) will collaborate with Casanare oil operators to offer educational opportunities to youth, Cusiana and Cupiagua communities call on Ecopetrol (NYSE:EC) to comply with prior promises and Parex has delivered a couple of community centers in Casanare. These and other Corporate Social Responsibility (CSR) reports.

The Impala river port in Barranquilla could be as ready as early as the end of January, as the company says it has met its obligations with the local community and even exceeded them. But a lower water level on the Magdalena River could be an issue as the port gets started.

The National Hydrocarbons Agency (ANH) says it is reviewing its options to protect Colombia’s oil industry against the fall of the price of oil, and will review consultant proposals on January 27.

GasThe number of Natural Gas Vehicles (NGV) in Colombia continues to grow, and now accounts for 2.5% of the global total of just under 20 million vehicles that run on natural gas.

The low price of oil could be an opportunity for Ecopetrol (NYSE:EC) to take advantage of smaller companies struggling with their cash flow and financial obligations and grow their proven reserves through acquisitions, argues a columnist.

Pacific Rubiales (TSX:PRE) continues to take a hit with investors, accumulating nearly a 50% drop on the TSX over the last month, with investors punishing the stock simultaneously with a company announcement last week that it would put exploration on hold to focus on production in 2015.