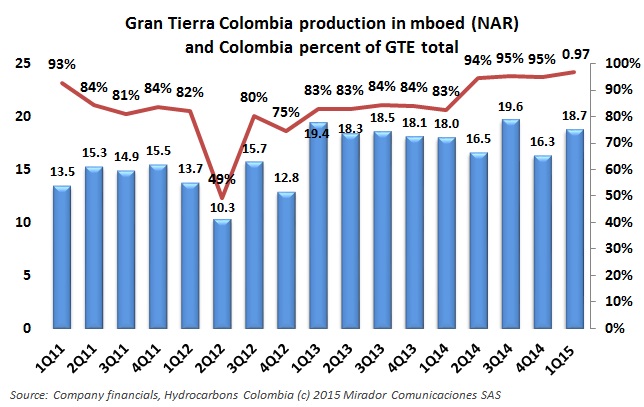

Costs associated with closed operations in Peru and the fall of oil prices cut into Gran Tierra Energy (TSX:GTE) financial results, but the firm says its production remains stable, looked to focus on cost cutting and would not comment on management speculation in its first quarter 2015 conference call.

Through the National Federation of Departments, Colombia’s governors have held an extraordinary meeting to align themselves and call on the government to release royalty funds assigned in the 2013-14 budget in their entirety.

The Farc attack in mid-April has eroded public support to its lowest point since the start of the peace process in November 2012, a Gallup poll has found.

The liberalization of the market and mass use of the domestic gas network, coupled with pricing decisions made on a political instead of technical or market basis is putting the country’s electrical energy supply at risk argues a newspaper column.

Company NewsBy now anyone with the most remote interest in the Colombian oil and gas industry must have heard the news. What follows are a number of perhaps irreverent reflections.

A potential plan from Ecopetrol (NYSE:EC) to farm out its smaller fields to private operators, one of the potential new strategy points mentioned by the NOC’s president Juan Carlos Echeverry, already has the USO oil workers union sounding alarms.

The Tauramena municipality, where the first public referendum against oil production was held, has changed its strategy and filed the first request in Casanare for establishing an environmental protection zone while Ecopetrol announces projects to reduce CO2 emissions. These and other environmental stories in our periodic summary.

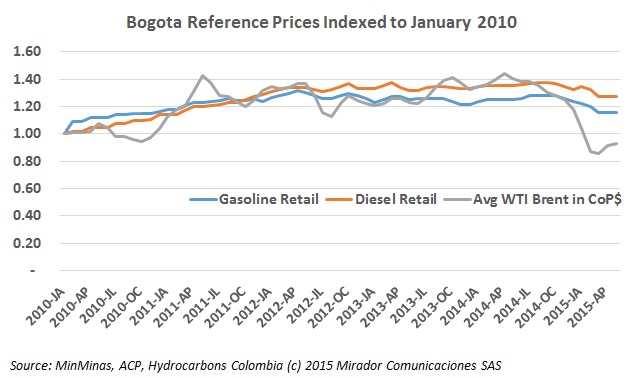

The Ministry of Mines and Energy (MinMinas) says prices will remain stable, while its own think tank questions the cost of subsidies to keep the price from rising.

No agreement can contemplate even a single day of jail for guerrillas Farc spokesman Ricardo Téllez, alias Rodrigo Granda said this week, setting the groundwork for what looks to become a make or break element of the talks.

Community buildings and common grounds were inaugurated in Pore with an investment from Parex Resources (TSE:PXT) and Geopark (NYSE:GPRK), while Ecopetrol invests in a production project and computer equipment in Castilla la Nueva. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.