Ecopetrol releases a statement denying dumping accusations while Puerto de Tumaco authorities question the Government response to oil contamination. These and other environmental stories in our periodic summary.

The transportation of crude in 2014 suffered a number of high profile attacks but the business remains solid, with Cenit and Ocensa leading the market in terms of sales

After repeated increases, the Ministry of Mines and Energy (MinMinas) said that diesel prices will fall to CoP$7756 (US$2.66) a gallon in Bogotá, a CoP$117 or 1.4% drop. Gasoline prices however will increase.

The Minister of Mines and Energy (MinMinas) Tomás González attended a recent summit organized by Bloomberg to reinforce the strategic position of the oil industry and that despite what has been said, everything is going well.

After royalty revenues dropped less than expected, Delegates of the National Federation of Departments met with the Minister of Finance to release royalty resources, meanwhile a new royalty spending transparency tool has been released. These and other stories in our periodic roundup.

Ecopetrol (NYSE:EC) and Anadarko (NYSE:APC) have announced a hydrocarbons discovery at their Caribbean offshore exploratory well Kronos-1, a development which has the government hailing that its offshore strategy is working while other industry members urge caution as the fruits of the find are still years to come.

The Amazon region represents both an area with interesting prospects for the hydrocarbons industry but also immense complexities.

The Minister of Mines and Energy (MinMinas) Tomas González said that its PIPE2 plan is already keeping investment in Colombia and production above a million barrels a day.

The Superior Tribunal of Pasto (Nariño) has ruled in favor of a Putumayo based indigenous association (ACIMVIO) and ruled against a prior decision from Interior Ministry to not certify the presence of the Inga group in an area of influence for a Gran Tierra Energy (TSX:GTE) exploration project.

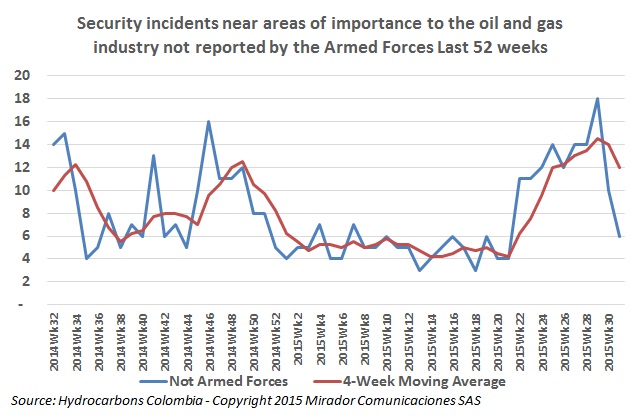

Guerilla-initiated incidents dropped close to the average experienced during the previous Farc unilateral truce. Half were attributed to the ELN but it would be difficult to unequivocally call the rest ‘truce violations by the Farc’.