The Comptroller General fears up to CoP$112B (US$35.6M) in project funding has been diverted by municipalities in the first half of 2015. 37 of these cases occurred in the Cesar department.

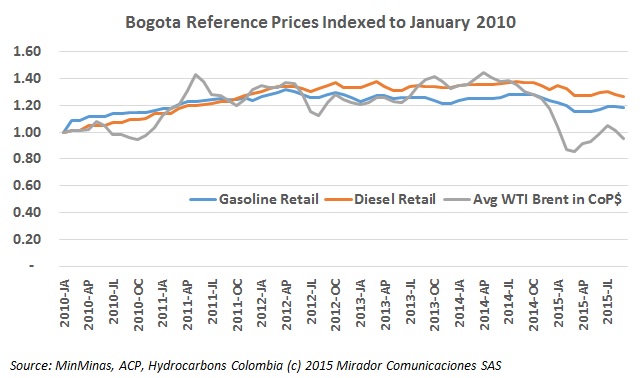

The Ministry of Mines and Energy (MinMinas) announced a slight drop in both diesel and gasoline prices for the month of September, moved by declines in international fuel prices. However the strengthening of the US dollar against the peso and rises in biofuel costs kept the final price from falling further at the pump.

The Colombian Association of Oil Engineers (ACIPET) held the XVI version of its Oil & Gas Congress last week, leading to a flurry of comments about the current state of the oil industry and its professionals from authorities and observers.

The fall in oil prices has caused a rethinking of budgets and projects, cutting into the potential for unconventional resources but not stopping any programs completely.

Equion supports sustainable poultry production in Casanare, while community members in Trinidad criticize Pacific Exploration & Production (TSX:PRE) for its alleged lack of support in road improvements. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.

After nearly two years and the intervention of the Labor Ministry, the USO say that they have forced Petrosantander to the negotiating table, despite the fact the company’s workers are already unionized under a different organization.

The sharp and precarious fall of oil prices has been felt from the Toronto Stock exchange, where most of Colombia’s operators are listed, all the way down to villages in the Colombian Llanos.

Pacific Exploration & Production (TSX:PRE) says that its Puerto Bahía port facilities in Cartagena have officially started operations.

Non-Armed Forces-reported incidents went up this week but virtually all were due to actions in the past like minefields or explosive caches and traps. Armed Forces-reported incidents were down in oil and gas-related zones.

The oil price crisis is forcing Colombian Oil Engineers to rethink staying in country or face an uncertain job market or unemployment, the Colombian Association of Oil Engineers (ACIPET) said during its annual oil & gas congress.