Non-Armed Forces-reported incidents went up by one this week and that brought the total incident count up by one. However that did not stop the 52-week average from falling to an historic low of 30 incidents per week. This is the safest 52-week period we have seen since starting tracking in 2012.

Eduardo Pizano, the president of Colombia’s Natural Gas Association, Naturgas, urged the government to speed up the process to issue environmental licenses for the production of Coal Bed Methane (CBM), which he said could provide an alternative source to increase the country’s gas reserves.

A national paper highlighted three examples in Colombia’s Caribbean coast of how hydrocarbons firms are both complying with environmental standards and engaging the community to create successful and positive social and ecological impacts.

Considering the recent findings in 2015 of Kronos-1 and Orca-1, last year, there are great expectations for offshore production, but the president of Schlumberger Surenco, Mauricio Vargas said that seeing production from offshore will take time.

A recent report shows that there has been a 17% reduction in attacks through July of this year, to total 73 acts of aggression against oil infrastructure. The number of blockades has also dropped compared to last year as well.

President Santos claims that the last couple weeks of the peace process has progressed more than in an entire year. “In these two or three weeks much more has been advanced than in the last six months or the past year,” said Santos. Dialogues have focused on justice and the end of the conflict.

A proposed change from the Energy & Gas Regulation Commission (CREG) that looks to facilitate the entry of new energy generators using more hydro, wind or solar power and lower “guarantee charges” has received some praise, while thermal generators say it could impact energy stability.

The sea port of Coveñas has seen an increase in its storage capacity to 1.24mmbl following new tanks installed by Ecopetrol (NYSE:EC) and its transport and logistics firm Cenit. The new tanks will also allow the Coveñas facility to export fuel oil.

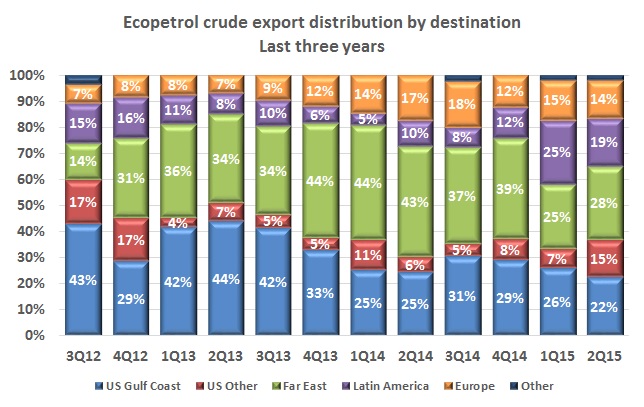

The last time we did this chart we concocted a marvelous story about Latin American customers wanting their oil without a heavy dose of Bolivarian rhetoric. Maybe we spoke too soon. Maybe not.

With Colombia’s current tax scheme on companies, it would be nearly impossible to recover lost investment due to the fall in oil prices, unless prices return to a level of around US$80/barrel, said Sebastián Borgarello, VP of Wood Mackenzie’s energy consulting business.