The former Vice-Minister and of Energy and former president of the National Hydrocarbons Agency (ANH) Orlando Cabrales has spent less time in public eye since leaving his post last year, but recently penned a critical article on the factors that have led Colombia to a shortage of natural gas.

The president of the Colombian Chamber of Oil Goods and Services (Campetrol) Rubén Darío Lizarralde warned attendees at an event in Barrancabermeja that Colombia’s proven reserves are enough to last for only six more years, and the current government strategy will not do much to change that. Ecopetrol (NYSE:EC) then responded.

A community in the Sogamoso Municipality, Boyacá claims that a seismic campaign in 2009 and 2010 has left a number of buildings cracked, including the local church, forcing residents out of their homes and affecting nearly 3,000 people.

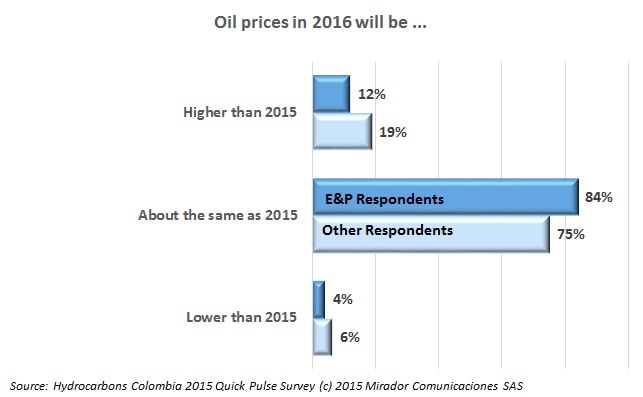

The fundamentals are not trending positively and so our readers are not planning for a brighter 2016.

This week “What we think” is really “What you think”. We broke our annual Quick Pulse Survey into two pieces, one addressing our traditional look ahead at 2016 and one addressing what we think is the main government policy issue at this time: incentives to get companies exploring again.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry has in the past defended what others consider high taxes on oil companies, but in a recent report a national radio chain says he sees the nearly 70% state take as being a barrier to foreign investment, affecting in particular exploration wells.

The USO held its Second National Assembly for Peace, in which it said that its work in a post-conflict it would focus on mining-energy policy, regional development and “promoting the culture of peace”.

Ecopetrol (NYSE:EC) says it has finished a demonstration plant in Chichimene in the Meta Department which uses a technology to lighten heavy and extra heavy crudes, allowing them to be shipped in pipelines while cutting the company’s need to purchase naphtha as a diluent.

Ecopetrol (NYSE:EC) is handing over three oil fields to its own subsidiary Hocol in Ortega, Tolima, which caused concern and even blockades by the local community.

Senator Manuel Guillermo Mora has called for the government to turn to coal instead of gas to supply thermal generators, and to establish a price stabilization fund using royalty savings.