The Constitutional Court has said that the definition of ‘zone of influence’ that MinInterior has been using to determine if indigenous communities need to be consulted is too restrictive.

The USO held a strike on March 17, and in the lead-up also launched its “United for Ecopetrol” campaign, which it says will defend Ecopetrol (NYSE:EC) against capitalist interests.

When President Juan Manuel Santos chooses a new Minister of Mines and Energy (MinMinas), they will not be arriving to a clean slate, and will be obligated to hit the ground running to deal with short term emergencies and longer term structural changes.

A shifting rationale and regulatory framework have meant that Colombia’s biofuels industry has lost its momentum, and industry associations say the government has not kept its end of the bargain.

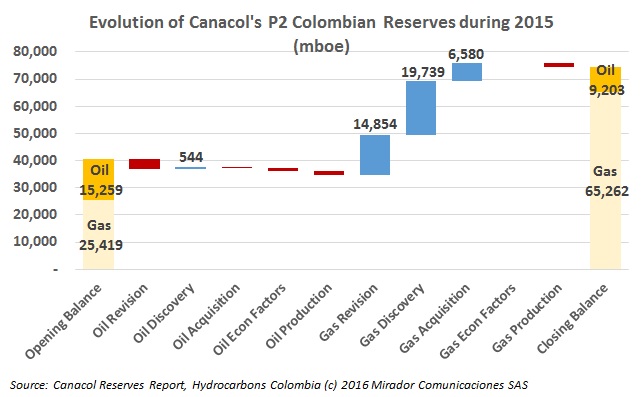

A bit of good news as Canacol Energy (TSX:CNE) posted a proved developed producing (PDP) reserve increase of 110%, and a 2P replacement rate of over 1000%.

President Juan Manuel Santos dispatched his brother Enrique Santos to Havana after differences on the final cease fire and the process to physically consolidate guerrillas in the post-conflict transition stalled the negotiating process.

When the replacement to now former Minister of Mines and Energy Tomás González is named it will be the sixth minister to hold the post in the last five years, an uncomfortable fact that points to a lack of proper planning.

Ecopetrol (NYSE:EC) says that a group of community members protesting a new hiring system –- an alternative to the notorious Community Action Committees (JACs) –- have turned violent and forced contingency measures at the Coveñas port.

Our Corporate Social Responsibility (CSR) editor has been consistently finding Ecopetrol (NSYE:EC) stories, both with a positive and negative tone. This demonstrates the important role of the NOC in shaping how Colombia views its oil industry.

Although it has served as a lightning rod for government criticism in Barrancabermeja, Santander, Ecopetrol’s (NYSE:EC) board of directors gave a definitive suspension to plans to modernize the city’s refinery in the 2016-2020 strategic plan.