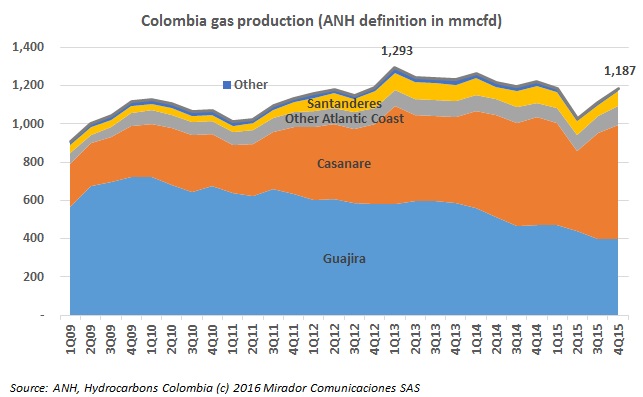

Traditionally, Colombians have thought of their natural gas as coming from La Guajira. Even when we started HCC in 2012, La Guajira represented 51% of gas production. But by 4Q15, that figure had dropped to 31%. Casanare is the new leader.

Representatives of the government and the ELN guerrilla have officially announced a start to talks after the latest round of informal discussions which took place in Caracas. The parties agreed to a six point agenda which will be similar to talks with the Farc, but move at its own pace and separately.

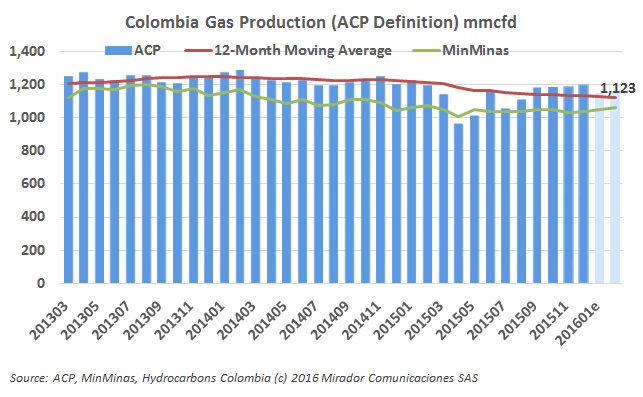

GasGas production has been above its 12-month moving average for at least four months and so what had been a strong decline in the trend-line has moderated. Could we be seeing the impact of new discoveries by Canacol (TSX:CNE) and greater production in Casanare?

The national government has set the limits of eight páramos, or high mountain tundra, to protect water sources which it says supply more than three million people. The protective order affects a total of 100,000 hectares of land in different parts of the country. This and other environmental stories in our periodic roundup.

A group of politicians in Meta have demanded explanations on the status of a planned refinery in Meta and how CoP$17B (US$5.6M) have been spent on the refinery, which still has not started the construction phase.

Ecopetrol’s (NYSE:EC) five year “Business Fabric” program has received national attention for its impact in 21 municipalities, credited with contributing to the development of local entrepreneurs and making the local economy more dynamic.

Some of the changes are detailed in the supply plan of the Energy Mining Planning Unit (UPME), which has identified the priority projects that it will tender directly, so that they are executed more quickly and not bottlenecked by market issues.

The Chamber of Oil Goods and Services (Campetrol) said that benefits offered by authorities to encourage exploration activity and make contracts more flexible are not having their desired effect, and more should be done to ensure exploration is restarted.

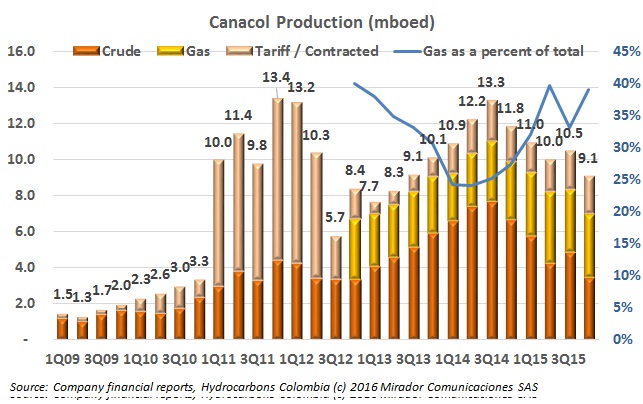

Canacol Energy (TSX:CNE) saw a drop in revenues and widened loss, as well as a fall in production, and confirmed that its management team is squarely focused on the opportunities for natural gas in 2016.

Chevron (NYSE:CVX) unveils a well and delivers food in La Guajira, in a campaign that benefits local indigenous communities and also includes its employees to gather the funds. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.