Juan Carlos Echeverry, Ecopetrol’s (NYSE:E) president, said in an interview that the NOC has been going through a deep cultural change prompted by the fall in oil prices. Local hiring, community relations, the ability to “sacrifice barrels” and environmental matters are some of the areas affected.

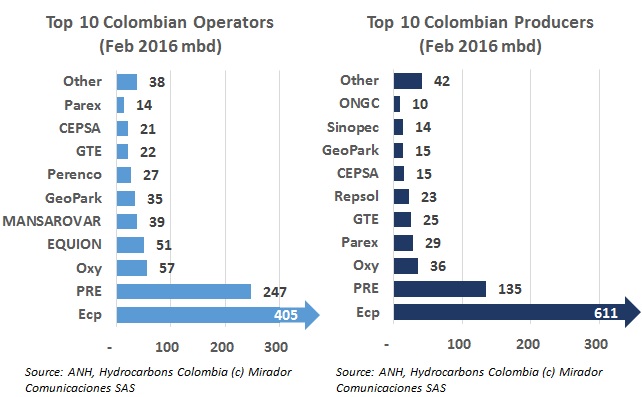

We have not done this graph for a while but a recent newspaper article which we thought was misleading inspired us to do it.

The ELN guerrilla group released three journalists, first Spanish citizen Salud Hernandez and then two RCN Noticias reporters, as the group continues to defy the government, complicating the potential start of peace talks.

The National Hydrocarbons Agency (ANH) said it will work more closely with local leaders in identifying and preventing community conflicts with the hydrocarbons industry, as the second phase of its Hydrocarbons Territorial Strategy (ETH).

Ecopetrol is working “intensely” to prepare for the reversion of the Rubiales field from Pacific E&P, as well as the Cusiana field from Equión. Workers currently at the Rubiales field say they are confident the NOC will hire them under the new contract.

Ecopetrol (NYSE:EC) has started executing an exploratory campaign using a Vibroseis truck in three different municipalities in the Caquetá department, and promised both work and investment for the local population.

The management of the Cartagena Refinery (Reficar) has responded to accusations of environmental damage from the nearby settlement of Pasacaballos, saying it meets all the requirements and takes care to protect the environment. This and other environmentally related stories in our periodic roundup.

The Chamber of Oil Goods and Services (Campetrol) said that the current complications, court decisions and low prices facing oil production will contribute to a 11.9% year-over-year for 2016’s average daily production, to render 885,000bd of crude output for the year.

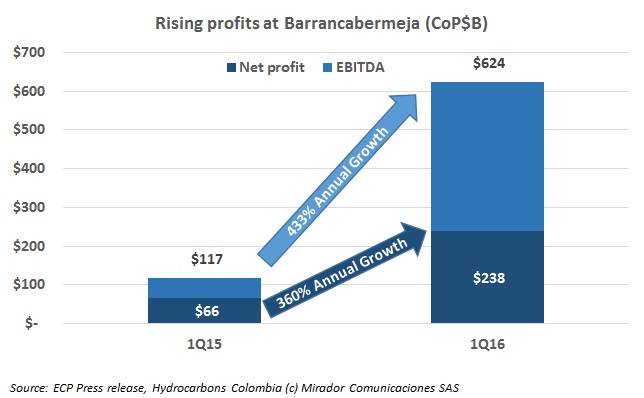

While the political clamor to modernize the Barrancabermeja Refinery continues, the facilities reported a net profit of CoP$238B (US$77.7M) in the first quarter of 2016, which represents a 360% improvement over the same period in 2015.

At least 90 cacao producers from Putumayo participated in a cacao ‘summit’ which took place in the department to debate the future of the industry, made possible with the support of Ecopetrol (NYSE:EC). This and other Corporate Social Responsibility (CSR) stories in our periodic summary.