Ecopetrol (NYSE:EC) is set to receive the Cusiana field from Equion on July 4th, and is in talks with the local community to identify social priorities which are aligned with the project.

Last week we did the top 10 oil producers so we thought we would start this week off with the top 10 gas producers and then look at the top 10 combined producers.

Canacol Energy (TSX:CNE) says that the firm has natural gas, it has clients that want to buy it, but it lacks the transport capacity to deliver it adequately, especially for new discoveries, and instead suffers from a “private monopoly”.

The government must take drastic measures to encourage investment in E&P, which is half of what it needs to be to keep current production levels. Otherwise the country will soon lose its oil self-sufficiency and the economic benefits, supply chain benefits and tax contribution that entails.

Ecopetrol (NYSE:EC) has signed an agreement with communities which affected its production in Chichimene, in the Acacías and Castilla la Nueva Municipalities, but reports show a willful criminal activity behind the protests, which could flare up again.

A pending wave of privatizations, and not just municipal utility ETB or Ecopetrol (NYSE:EC), is under way, warns the USO after joining another organization which is planning a string of protests to stop this alleged plot.

Editor’s Note: This was sent to us because we are on ACIPET’s press release distribution. When we started to read it, we thought it was tutorial material, a kind of Petroleum 101.

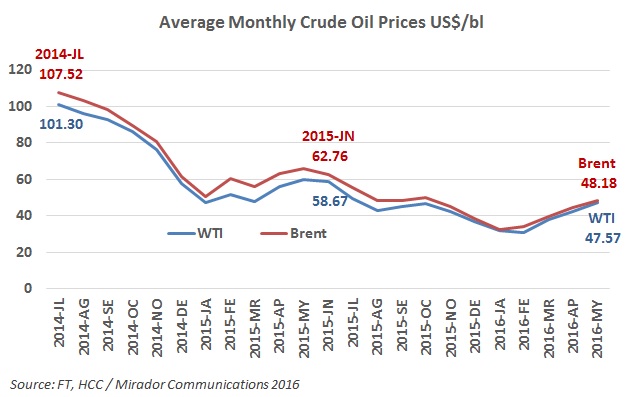

The rally in oil prices continues. Prices have risen now for three successive months in the case of WTI and four in the case of Brent. It has been difficult to break US$50 but we think traders are beginning to believe in this number.

Colombia’s Central Bank released Foreign Direct Investment (FDI) and related figures for 2015 and the 1Q2016, showing a drop in both investment received and the profits obtained locally due to these investments, although some other sectors show signs of recovery.

Senator Fernando Araújo pointed out the benefits that the modernized Cartagena Refinery (Reficar) has contributed and will bring to the local community, and called for specific investments to mitigate faulty infrastructure in the nearby communities.