Attacks by the ELN guerrilla on the Coveñas/Caño Limon pipeline have rendered US$20B in damage to the oil infrastructure and another US$20B in environmental damage in the last 28 years, according to data released by Colombia’s Attorney General’s office.

An urgent agreement is needed to reactivate the oil industry. Colombia might have potential for oil, but it is not an oil country. This must be taken into account when forming competitive strategies to attract investment, said Juan Carlos Rodríguez Esparza, president of the Colombian Oil Engineers Association (ACIPET).

The National Agency of Environmental Licenses (ANLA) will be headed up by one of its current functionaries, Claudia Victoria González, after a previous candidate named by the Minister of Environment Luis Gilberto Murillo was ruled out, leading to public tensions.

Ecopetrol (NYSE:EC) is passing through a test due to fallen production and low prices, says the former Minister of Mines and Energy Amylkar Acosta, who believes that the NOC will be able to make it through, but without any idea of when this could conclude.

A feature in a national magazine explores the case of the Emerald Energy’s Nogal Block in Caquetá, which it says has become a symbol of resistance against oil production in the Amazon.This and other stories in our periodic summary.

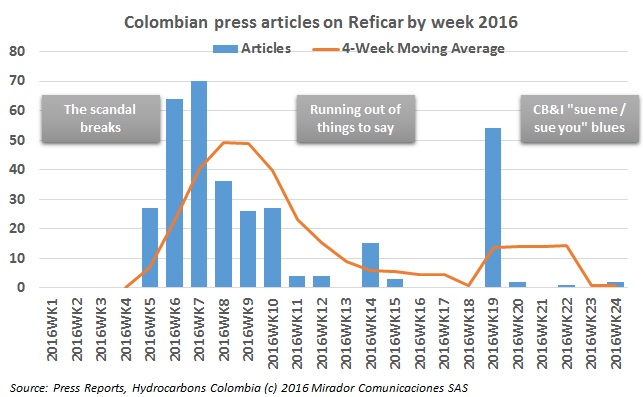

The scandal surrounding the Cartagena Refinery (Reficar) might have fallen to a secondary status, but continues to make headlines. A Senate hearing last month, accusations of environmental damage and a full audit by the General Controller’s office have all taken shape over recent weeks.

When the World Economic Forum opens its Latin American conference in Medellín this week, the Finance Minister Mauricio Cárdenas will unveil “the new economy” of Colombia, which is no longer dependent on oil prices or minerals, but instead on large agroindustry projects and tourism.

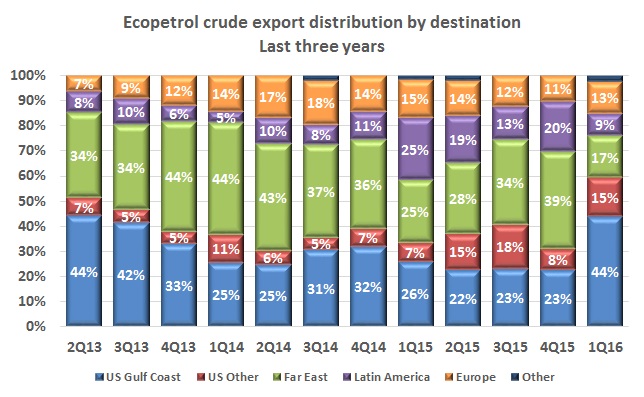

Ecopetrol’s (NYSE:EC) export distribution in 1Q16 showed a big shift to the US, the Gulf Coast in particular, and away from the Far East, which had been a strategic market for the NOC.

The USO has again railed against proposed changes to Ecopetrol’s (NYSE:ECP) health benefits, which it alleges will lower the quality of health professionals and put its workers at greater risk.

The restructuring process of Pacific E&P will take place in the Canadian legal system after both US and Colombian authorities announced they would support this process, although Colombian regulators have ordered the firm to guarantee payments for its Colombian creditors.