The Minister of Mines and Energy Germán Arce warned that there is a potential that groups with interests in illicit activities have taken to industry blockades negotiate specific demands, and these should not be confused with traditional anti-oil protests.

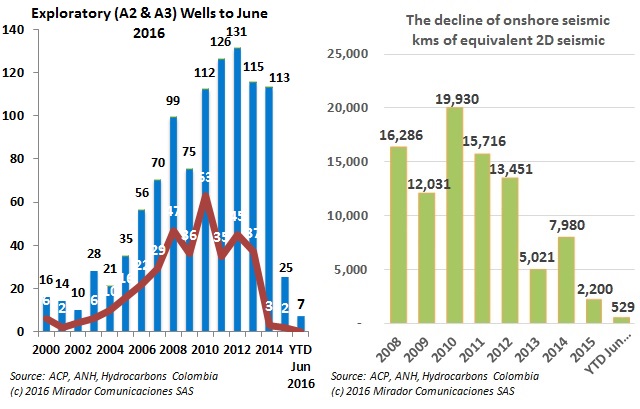

Improved oil prices have not done much to improve exploration activity in Colombia which is far short of past years and seismic activity has mostly been offshore. However according to the Colombian Petroleum Association, the activity could still meet with the association’s goals for the year.

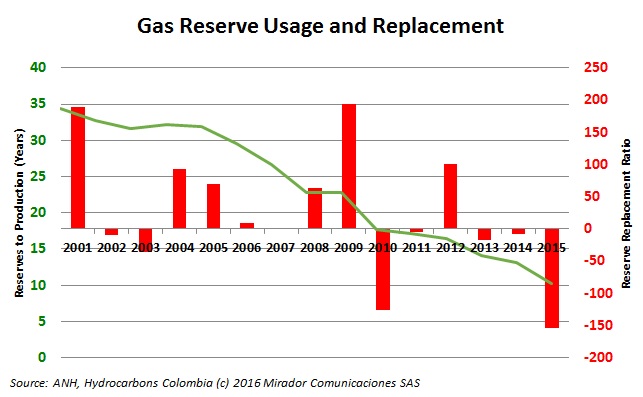

GasAn expansion of the transport system for gas is required for the investment in exploration to increase, according a study to the Energy Mining Planning Unit (UPME), which also found there is enough supply to meet demand only until 2023.

The Colombian Chamber of Oil Goods and Services (Campetrol) performed a survey among its members and found that between January and May of 2016 blockades and strikes led to lost daily production of 9,000bd.

A forum took place at the Bogotá-based Pontificia Universidad Javeriana, jointly organized by Crudo Transparente and the Pensar Institute, with the aim of discussing the difficult relationship in Colombia between the population and the oil industry. We attended the kick off meeting and brought back this report.

The departments of Caquetá and Putumayo will see a greater concentration of exploration and production activity, and will likely be included in the upcoming Colombia 2016 round.

Everyone in the industry is concerned by the rise of violence against the oil industry over the past few months.

Hydrocarbons Colombia was present at a Campetrol-organized conversation on the peace agreements. We brought back a brief overview of the talk.

The board of directors of the USO oil workers union said that problems in creating a dialogue with Ecopetrol (NYSE:EC) have led it to convoke a general strike of the NOC’s direct and contract workers. The union claimed the strike is necessary to avoid the privatization of Ecopetrol.

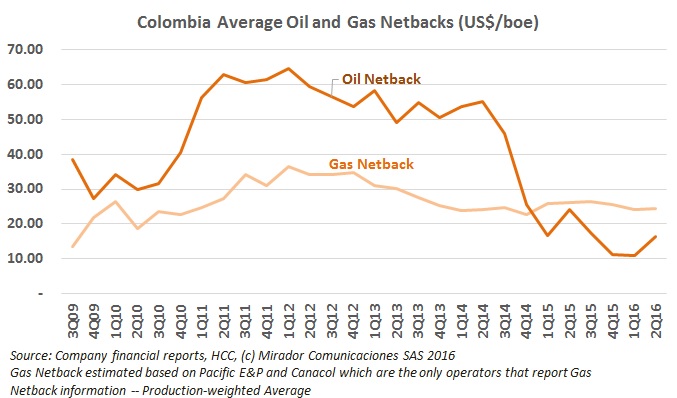

The graph shows that gas continued to be a better business than crude oil in 2Q16 despite rising oil prices which boosted oil netbacks.