With the recovery of oil prices, GeoPark (NYSE:GPRK), which has been in the country for four years, has positive prospects for 2017.

A port investment group (PIO SAS), is pushing forward to build Colombia’s second regasification plant called Puerto Solo, which would be located in Buenaventura, following the inauguration of Colombia’s first regasification plant Puerto Cayo in Cartagena.

The National Hydrocarbons Agency (ANH) expects oil price improvements to give a boost to exploration activities in 2017, and that in Colombia there will be more than 40 exploratory wells next year.

The USO is the union for Ecopetrol (NYSE:EC) workers and, perhaps surprisingly, one of the loudest voices against the oil industry and the ‘evil multinationals’ who dare to operate in Colombia.

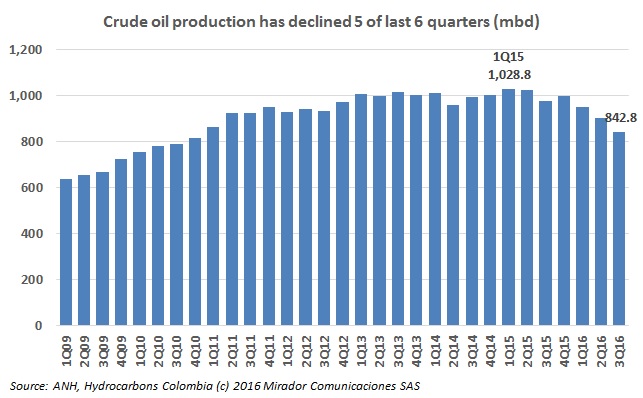

The drop in crude oil production during 3Q16 was the steepest quarter-over-quarter drop since 4Q01, well before anyone in the Colombian government thought about transforming the industry.

Oxy (NYSE:OXY) has restarted production at the Caño Limon field after halting the operation for more than a week following an escalation of attacks on the Coveñas/Caño Limon pipeline by the ELN guerrilla.

The USO said that by appointing Luis Guillermo Vélez Atehortúa as head of Ecopetrol’s health administration, Juan Carlos Echeverry made a ‘tactical’ move to begin to diminish the guarantees of the 70.000 users of the health system, embodied in the collective labor agreement.

With the Reficar and Bioenergy cost-overrun ‘scandals’ making the front pages once again, Ecopetrol (NYSE:EC) CEO Juan Carlos Echeverry is trying to get the press and public to focus on the positive: the uplift to production of refined products from the two plants.

The Energy and Gas Regulation Commission (CREG) recently organized an event to show its results during 2015 and 2016. HCC was present at the event; we bring a brief summary of the meeting.

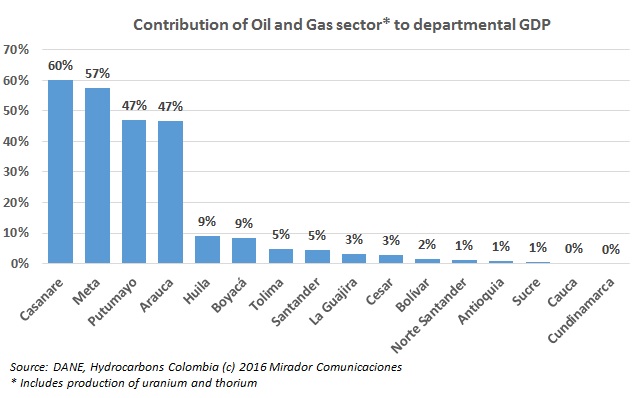

A recent report from the government’s statistics bureau DANE confirmed that in 2015 the departments of Meta, Casanare and Santander represented 75% of the oil industry’s value in GDP terms. We looked at something related but more interesting as shown in the above graph.