After the report presented by the Office of the General Comptroller on CBI and Reficar’s contracts, there are “more questions than answers.” According to the Colombian press there would be a loss to the nation of CoP$8.5T, but the presumed cost overruns should be examined in detail.

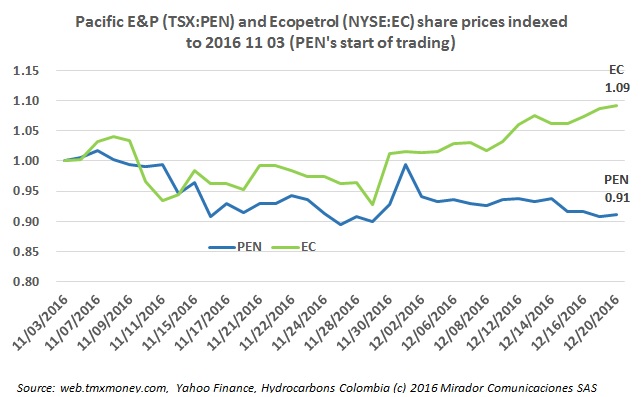

Pacific Energy (TSX:PEN) is closing 2016 in much better shape than it started, and following its nearly yearlong process of crisis and restructuring, is valued at just over US$2B based on current market figures. But investors are still wary of the firm’s shares.

The legal process to start the peace transition continues with an amnesty bill passing its first debate in congress, but the general public is skeptical on the agreement and its potential to bring peace.

Another tidbit from the ongoing discussion surrounding new taxes levied as part of Colombia’s tax reform: a proposed carbon emissions tax will be levied on the producers of fossil fuels, oil derivatives and importers, not on the consumers which use them.

The Minister of Environment (MinAmbiente) Luis Gilberto Murillo explained that green taxes, like a levy on carbon emissions, are important for Colombia’ sustainable development and for meeting the country’s environmental goals.

Hocol’s permit to develop the Toldado field was suspended by Cortolima due to environmental requirements and Ecopetrol (NYSE:EC) had to take action on alleged leaks detected in Santander. These and other environmental stories in our periodic summary.

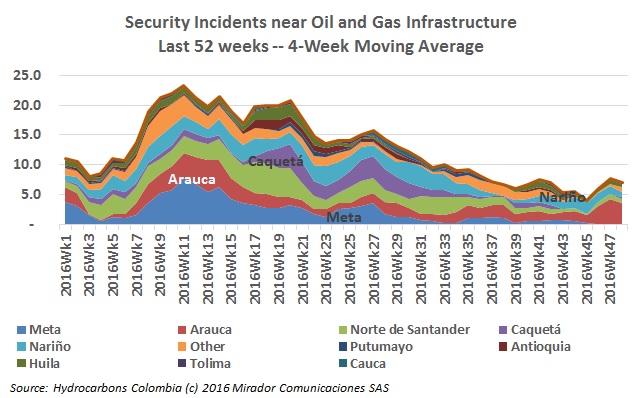

Now a larger problem than attacks on pipelines or facilities, the illegal drug and mining trade and groups linked to the ELN guerrilla which steal crude using illegal valves has become one of Ecopetrol’s (NYSE:EC) primary concerns, and the activity also damages the ecosystem.

The Energy Mining Planning Unit (UPME) has updated its interim natural gas plan and warned that even though there are more years of natural gas reserves in the country than those of crude, this fuel has more worrisome consequences if supply becomes scarce. The UPME reinforced plans for importing.

An attempt by congressional members to place a tax on natural gas brought about a quick rejection from the Colombian Natural Gas Association (Naturgas). Lawmakers appear to have backed down, but it raises a number of questions as to the tax strategy for fossil fuels.

Ecopetrol (NYSE:EC) budgeted over CoP$10B for projects to improve the conditions and quality of life in communities of Meta, Casanare and Vichada. These and other Corporate Social Responsibility (CSR) projects in our periodic summary.