The Energy and Gas Regulation Commission (CREG) released its management and results report for 2016. Last December CREG gave us a global balance for the year. This report goes into more detail on the regulated sectors. We will focus on Natural Gas and Propane.

This week, USO reported negligence by Ecopetrol (NYSE:EC), Mansarovar Energy and Duflo regarding workers’ conditions in their facilities, and stressed the need to defend Ecopetrol as a “State owned company.”

Employees of Equion Energy Limited gathered at their Yopal facilities in Casanare, to celebrate the company’s sixth anniversary.

So January is in the books. The groundhogs have pronounced on winter (split decision) and as an old boss of mine used to say with a slight note of panic in his voice “One twelfth of the year has gone by! One third of the first quarter is over! What have we accomplished!”

Last week we separately published graphs of our monthly counts of security incidents and of blockades in all of 2016.

Boyacá has a royalty budget of CoP$893B to finance 522 projects. However, the fact that there are pending balances for an amount of CoP$86B in 40% of the department’s municipalities is a cause for concern by local authorities.

National government presented the “Crecimiento verde” (green growth) strategy. This mission will provide tools to meet pollution targets and implement OECD recommendations. The Ministry of Mines and Energy will join this initiative.

It seems like Farc’s mobilization to the concentration rural areas has been successful so far. However, there is concern among public officials over those who are coming to take the Farc’s place in the areas they dominated for decades.

Our summary statistic went up, but the components acted, well, unexpectedly. As often happens, our qualitative assessment of the month is different from the quantitative.

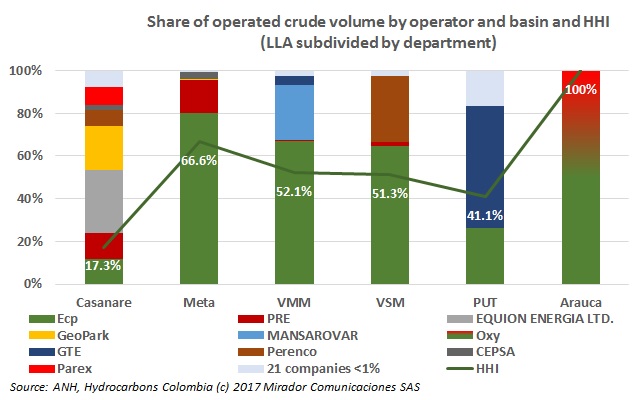

This week’s “From our Analyst’s Desk” deals with market concentration, an economic concept regulators use to decide if there is or is not sufficient competition in an industry. That was a Colombia-wide view. Here we break down the results by basin.